Industry Profile - Interactive

August 2025 Profile

Introduction

The term interactive digital media (IDM) accounts for a range of digital content and experiences available through a variety of digital platforms such as PCs, mobile devices and game consoles. IDM in Canada is a growth industry that is quickly changing, driven by shifts in consumer behaviour and technology. IDM content includes but is not limited to video games, cross-platform entertainment, virtual, augmented, and extended reality content, web series, and e-learning products.

Industry Size and Economic Impact

The following information on industry size, activity, revenue, and employment should be considered a snapshot of activity in the industry based on the best available information.

Revenues, Production Volume, and Employment

- Pre-COVID-19 the IDM industry in Ontario consists of 929 companies, almost half of which (49%) employ five or fewer people.[1] These companies employ 12,300 full-time equivalents (FTEs), 8,680 of which specifically perform duties related to IDM.[2]

- The COVID-19 pandemic had a demonstrable impact on Ontario’s IDM industry, with an early pandemic-era survey from Interactive Ontario (IO) highlighting that company respondents experienced an average monthly revenue decrease of 38%, and self-employed individual respondents indicating a 55% decrease in monthly IDM-related income.[3]

- Notably, over one third (37%) of Ontario’s IDM companies are primarily involved in game development or publishing, with the next most common line of business being virtual/augmented/mixed reality.[4] Moreover, 40% of the companies in this study reported a non-IDM activity as their principal line of business, with linear audiovisual content production constituting a large portion (38%) of these “other” lines of business.[5]

- A substantial portion (over 90%) of the revenues for Ontario IDM companies comes from export, with the United States and Continental Europe being the two largest markets.[6] In 2022, total international exports of Ontario IDM products were approximately $331 million.[7]

- IO’s research about the impacts of the IDM sector from 2019 highlights several key challenges facing Ontario’s IDM companies, including the value of the Canadian dollar, workforce challenges around finding skilled labour within and outside the province, cost of living and affordability pressures on salaries.[8]

- Many of these challenges still resonate today, as showcased by IO’s published research that examines how the sector can address its needs related to labour demand and growth.[9] The report highlights several factors, including that the demand for creative technology talent (including technical and artistic roles) has persisted despite challenging economic headwinds, and that the fast-paced growth of the industry has created recruitment and retention challenges for creative technology employers.[10] Finally, the report highlights a particularly acute crunch for intermediate and senior-level talent.[11]

Videogame Industry

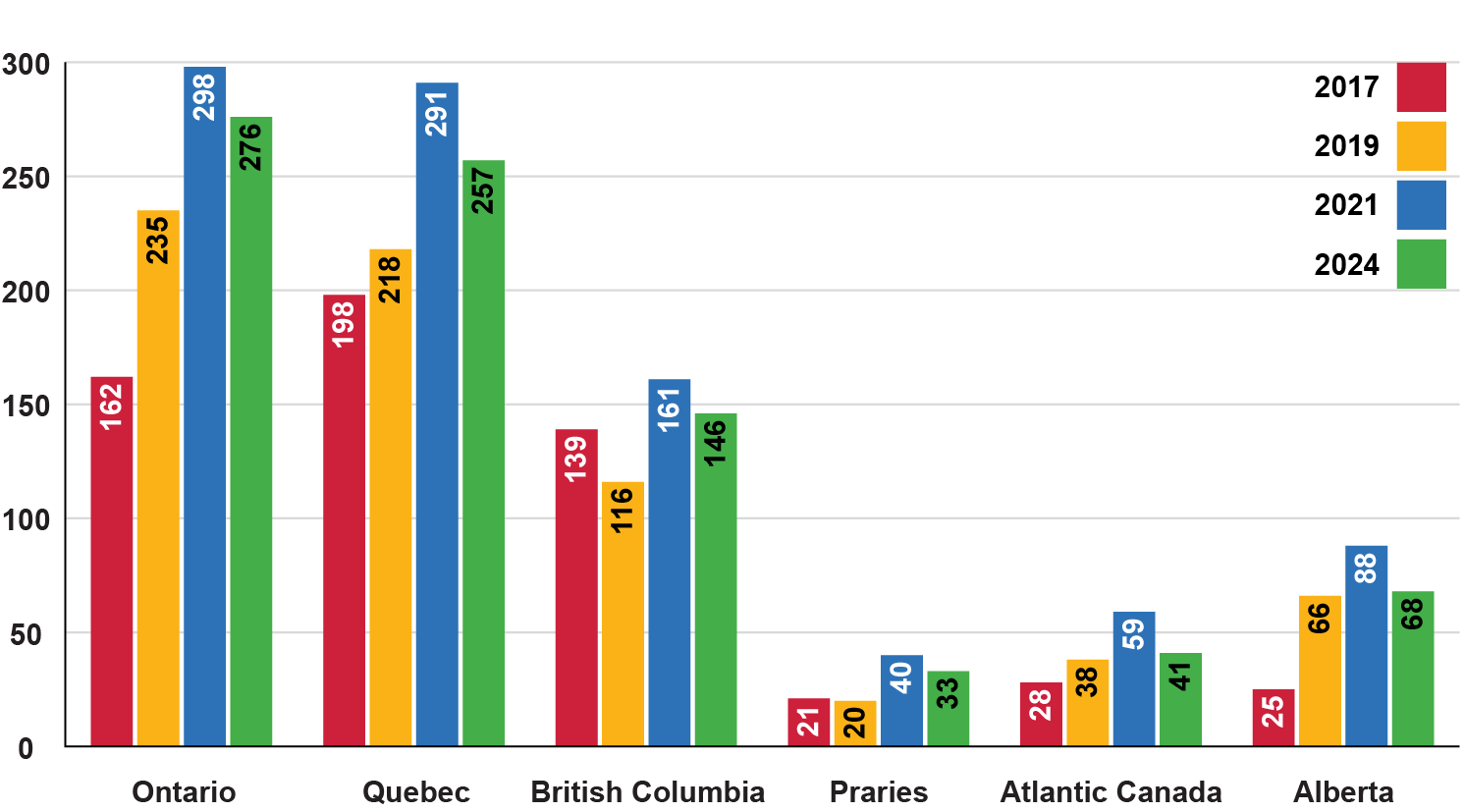

- The latest Data from the Entertainment Software Association of Canada (ESAC) indicates that in 2023-24, video game companies in Canada generated an estimated $5.1 billion in revenues and supported an estimated 34,101 FTEs.[12] A significant share (88%) of these revenues are from export markets outside of Canada.[13] This data also highlights that Ontario is home to 276 video game companies, the most of any province.[14]

Geography of Canada's Video Game Industry, 2017-2024

Source: Entertainment Software Association of Canada, The Canadian Video Game Industry 2024, 2024, p. 4.

- There are 821 video game companies currently operating in Canada in 2023-24. While they operate country wide, the largest concentration are in Ontario, British Columbia and Quebec. These 3 provinces are home to 83% of all video game companies in the country.[15]

- Since 2021, there was an overall contraction of companies, down 9%, or 78 companies. While micro (2-4 employees) and very small (5-10 employees) companies saw the majority of losses, there was a 98% increase in sole proprietorships since 2021.[16] It’s believed that micro companies closed or downsized due to the challenging environment, and may have caused the growth in sole proprietorships.[17]

- While nationally, video game companies directly employ 34,010 FTEs, with the majority of direct employment is generated by a small number of massive companies. The 25 largest companies were responsible for 58% of the FTEs.[18]

- Foreign owned companies account for 88% of the total industry employment, up 5% since 2021.[19] As a result of foreign ownership, the largest share of revenues is intercompany/Transfer pricing which accounts for 45% of the industry’s revenues. In-game/in-app sales were 2nd comprising 21% of total revenues.[20]

- On average, a full-time employee in this industry earned approximately $102,000 in 2024, an increase of 21% from 2021 figures.[21]

- ESAC’s data also demonstrates that the workforce remains primarily composed of individuals employed on a full-time basis (86%). The proportion of contract/freelance workers has declined from 2021 and sits at 13%.[22]

- The Canadian video game workforce remains largely composed of men, with women accounting for 26% of the total workforce, an improvement from 23% in 2021 and 19% in 2019.[23] On average, 62% of women work directly on games, and are more likely when employed with a smaller company.[24]

- The majority of Canadian video game revenues come from export, comprising 88% of industry revenues. This is an increase of 4% from 2021.[25]

- According to data collected by ESAC, the majority (56%) of Canadian video game companies have not developed any program to support equity, diversity and inclusion in their workforce.[26] Large companies (defined as companies with between 100-399 employees) were more likely to have adopted a formal EDI program.[27]

- Recent research from IO has identified several strategies to addressing diversity in hiring and recruitment (among other areas), including the introduction of inclusive website language, EDI policy transparency, inclusive job posting language, transparent and standardized hiring practices, salary transparency, and reciprocal partnerships with organizations serving or representing equity-deserving groups.[28]

- A 2023 report by Interactive Ontario explored the scaling up of video game companies and identified three key needs for organizations in growth mode: forming strategic partnerships to enter global markets, accessing financing and capital, and acquiring the skills and expertise necessary to develop management teams.[29]

- Mergers and acquisitions continue to play a significant role in the global videogame marketplace. In 2024, the number of mergers and acquisitions increased 22% from 109 in 2023 to 133. While the number has increased, the value has dropped 46% due to the lack of a major deal. The value of gaming investments for the first year quarters of 2024 was $6.7 billion USD which outpaced 2023.[30]

- While the Metaverse was one of the most buzzed words of 2023, PwC also notes that investment interest has shifted away from the metaverse, and towards artificial intelligence (AI) and large language models in 2023.[31]

Consumer Market

- According to, Canada’s video game industry generated annual revenues of $4.4 billion USD in 2023, and is expected to rise at a 3.7% CAGR over the forecast period (2024-2028).[32] PwC’s analysis highlights that a large portion of this revenue ($2.8 billion USD) is generated from social and casual gaming, and this segment is expected to continue to grow at a 5.1% CAGR rate over the forecast period.[33] Currently, app-based social and casual gaming account for the majority of this growth, but in-app games advertising is growing at a 9.7% CAGR and is expected to equal app-based social and gaming revenues by the end of the forecast period (2028).[34]

- Traditional gaming revenues were valued at $1.5 billion USD in 2023, but the sector will be rising slowly at 1.2% CAGR, and hit $1.8 billion by 2028.[35] Part of the reason for the slow growth is the falling sales of console games. In Canada, the sales of physical console games are expected to decline rapidly at a rate of -11.2% CAGR, along with a stagnation of digital games.[36]

- PC gaming continues to be popular in the Canadian marketplace, growing at a 1.3% CAGR over the forecast period of 2024-2028 but still only accounting for around one quarter of total market share.[37]

- Cloud and subscription gaming is an emerging gaming sector which is on the rise. 2023 saw revenues of 506 million, and is increasing at a steady CAGR of 6.2%.[38]

- A 2023, national video games associations from around the world issued a survey to examine the habits and behaviours of video game players. 12 countries, from five continents were included in the survey.[39] In Canada and across the world , survey respondents said the top three reasons for playing videos games was to have fun, to pass time and stress relief/relaxation.[40] In Canada 76% of respondents found that video games helped them fell less stress, 63% less anxious and 52% reported that video games helped them fell less isolated. More than 50% of players felt that playing video games helped their mental health and provided a healthy outlet[41]

- Respondents felt that gaming improved their creativity, problem solving, cognitive and collaboration skills. Many felt that video games were a strong way too connect with others.[42] In Canada, 24% of respondents said they played games on a daily basis with others online, while 51% said they do it on a weekly basis.[43]

Trends and Issues

Growth Rate and Industry Trends

- Globally, according to Newzoo, the global video games market will reach $187.7 billion USD in 2024, a 2.1% year-over-year increase. Mobile games were projected to generate a 3% increase year on year at $92.6 billion USD, and represents nearly 50% of the global games market. [44]

- Looking forward, a report from MIdia Research projects that hardware revenues are projected to grown by 8.4% driven by the Switch 2 launch.[45] They also predict that premium titles will get a renewed focus from developers following an oversaturation of live-serves games, from which they forecast that in-game revenues will 67% by 2031.[46]

- Multi-game subscriptions like PlayStation Plus and Xbox Game Pass were once lauded as being disruptors of game distribution but data shows that their revenues are already beginning to reach maturity. MIDia Research has predicted that while overall, the subscriptions will see a 5.9% CAGR from 2025-2031, year-on-year growth rates will decrease each year, slowing from 11% from 2024 to 2025, to 4% from 2030 to 2031.[47] One reason behind the slowing growth is that consuming games demands more time that other mediums, and that many games are by free-to-play markets or a select number of premium games a year.[48]

- PwC’s projections show that the total global video games sector, including esports, is expected to reach $334 billion USD by 2028, which is a CAGR of 8%. This growth will be driven primarily by the rapid expansion of social and casual gaming globally, and in-app games advertising.[49]

PwC also noted that 2023 marked the end of global esports’ rapid growth phase and will enter a period of steady but slowing growth. Total esports revenues is forecasted to from $1.9 billion USD in 2023 to $2.8 billion USD by 2028, which is an 85% CAGR[50]. 44% of all esports revenues are generated through sponsorships which is forecasted to maintain.[51] - In Canada, esports achieved a 14.8% year over year growth from 2022 to 2023 with revenues reaching $35 million USD.[52] In a departure from global trends, the majority of Canadian esports revenues come from media rights, which represented 37% of the market, and $13 million in revenues in 2023. Media rights are also the fastest-growing sector of the Canadian esports market, but is expected to slow by 2028.[53]

- In the last 10 years, Indie and solo-developed games have started to incrementally eat into a larger share of games sales through wide abundance of developer tools and innovative games. In 2024, on Steam, full game revenues from indie developers jumoped to 48%, up from 31% in 2023, accounting for close to $4 billion in revnues.[54]

- Video games gave been increasingly used for non-entertainment purposes. A 2024 report from ESAC highlighted how different Canadian organizations are utilizing video games for non-consumer uses. Organizations have implemented video games use for physical rehabilitation, mental health initiatives, education, forstering community and connections, and induatrial with the use of simulators.[55]

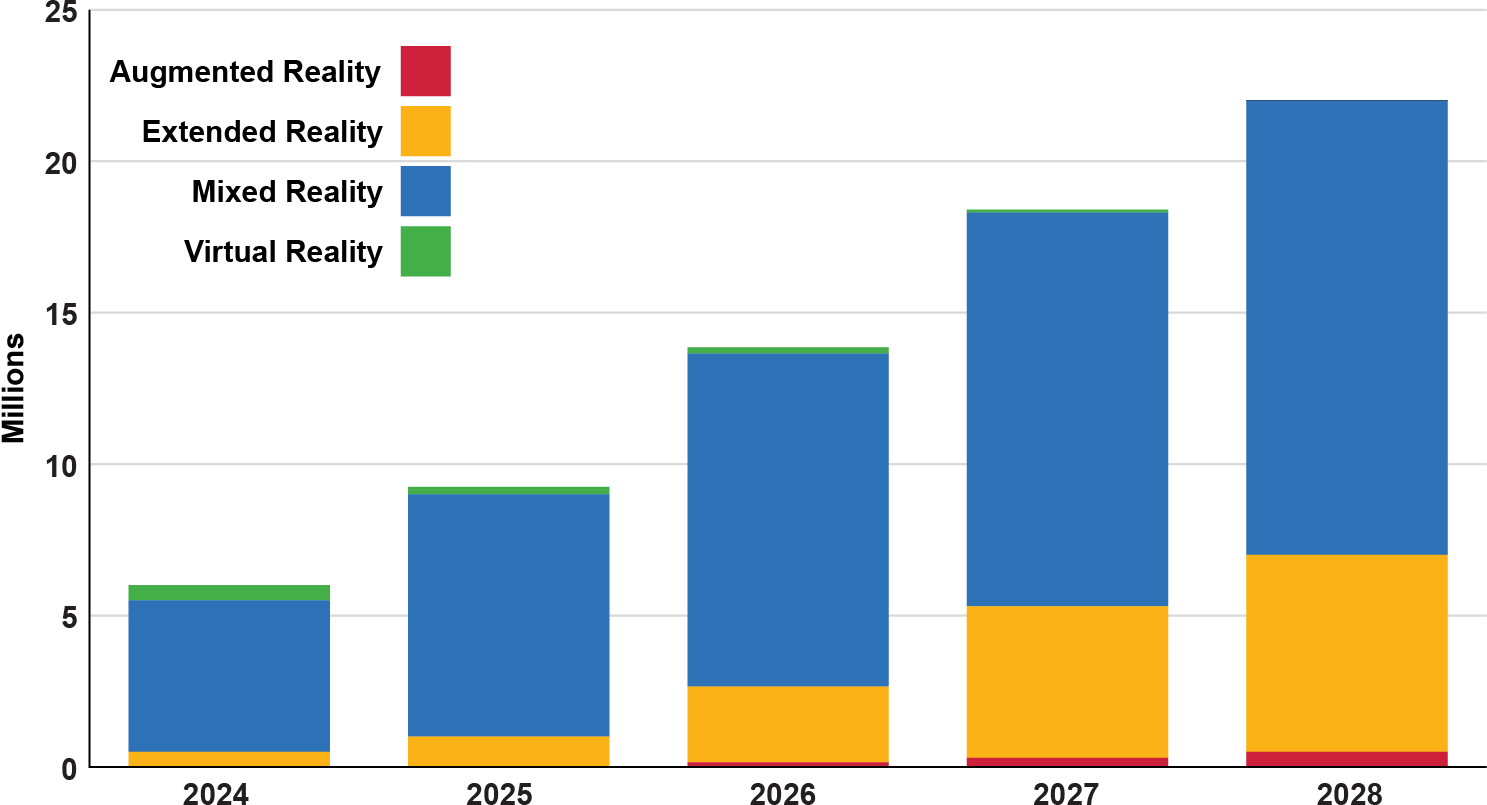

- Canada’s virtual (VR) and augmented reality (AR) marketplace is growing at a rate of 12% CAGR. The Canadian VR market is expected to grow from $77 million USD in 2023 to $118 million by 2028.[56] VR gaming revenues peaked in 2022 and had seen a decline, but are projected to surpass those levels by 2028.[57] While VR video accounted for on 10% of VR revenues in 2023, it’s expected to grow by 34% CAGR by 2028.[58] Both the installed base of VR headsets and the share of standalone VR headsets are projected to grow over the forecast period, though the share of tethered VR headsets is expected to decrease to 16% in 2028.[59]

- Canada’s mobile AR market represents just 6% of the North American market and amassed $700 million USD in revenues in 2023.[60] Advertising accounted for 92% of AR revenues, but the market is expected to grow at a rate of 12.5% CAGR to 2028.[61] Non-gaming applications account for the majority of revenues including social media platforms like Facebook, Instagram and Snapchat.[62]

- IDC is forecasting a decline in dedicated VR headsets, over the next few years, while seeing a rise in Mixed Reality and Extended Reality products.[63]

Worldwide AR/VR Forecast by Product Category, 2024Q3

Source: IDC Meta Sets the Bar in AR/VR, but Competition is Gearing Up for a Reality Check, According to IDC, December 16, 2024

- The models of work in the video game industry has changed like many in the past number of years. Flexible work policies are now widespread, and the size of the company has a direct impact on the modes of work. Hybrid work is the preferred mode for both large and very large game companies, while remote work is the overwhelming choice for sole proprietorships, micro and very small companies.[64] A 2023 study by the Game Arts International Network looked at alternatives to traditional employment, and 50% of the respondents were enthusiastic about 4 day work week models, while an additional 21% reported that it had already been implemented at their studio.[65]

- AI tools have been used in the video game industry for over a decade. With the rise of new AI models, video game companies are adopting them for various needs. From an ESAC poll, they are primarily being used for brainstorming and idea generation.[66] Similarly, 25% of respondents do not currently use generative AI but plan to in the future, while an additional 27% don’t plan on using them in the future.[67] The CEO of EA recently stated that generative AI could be used in more than 50% of the company’s game development process.[68]

- Recently AI models have started being implemented for programming NPC (Non-Player Character)’s. It’s reported that for AAA games, sometimes up to 500,000 lines of dialogue have been written.[69] Generative AI has started to be used to by studios such as Ubisoft to generate NPC dialogue, so that human writers can pick and tweak the generated text and focus on more plot focused writing.[70] Similar tools are also being developed to allow NPC”s to respond to players with unscripted dialogue so that they never repeat themselves.[71]

- While AI implementation is mostly talked about in reference to content creation, it’s also being used for content moderation. Recently AI tools have been used on both Roblox and Call of Duty to determine is a player is using inappropriate language. If so they will issue a warning and later a ban if the language doesn’t stop.[72]

- Gig platforms like popular Fiverr have started to enter the gaming market where developers offer products for as little as $5 USD. In 2019 Fiverr launched a dedicated gaming store. Products and services offered on these platforms varies from compete custom games to art swaps. While the graphics and mechanics of the games may be limited, due to the low costs, these gig work platforms are often used to offset production costs[73]

Global and Domestic Issues

- 2024 was a tumultuous year for video game developers. In 2023, more than 10,000 layoffs took place affecting programmers, QA, sound designers and artists.[74] 2024 continued that trend and saw global layoffs surpass those in 2023 just six months into 2024 and expected to be more than 40% higher than the previous year.[75] The reasons for the layoffs are complex, but some issues for the job losses are development costs, how studios are staffed, consumer spending habits and game pricing. Indie developers were also affected, even those owned by large tech corporations as the industry saw a large contraction. [76]

- 2024 also saw online harassment campaigns against DEI and the diversification of games. Games with diverse or female leads characters, or games that allowed for inclusive customizations saw targeted online attacks from anti-“wokeification”. Some games that weren’t even released faced online harassment due to the looks of a diverse character.[77]

- In a first of its kind, in early March 2025, video game workers landed an industry wide union for works in both the United States and Canada. United Videogame Workers-CWA Local 9433, a direct-join, industry-wide video game union with the Communications Workers of America (CWA) in partnership with the American Federation of Musicians (AFM). The launch was formally announced at the 2025 Game Developer Conference. The union will include video game workers as well as freelancers, indie developers, workers who are currently unemployed, and workers who are already organizing their workplaces.[78]

- Unstable trade relations between the United States its traditional trading partners have become tumultuous as of late due to multiple factors including tariffs. Looking at IDM industries, there are multiple way these industries could be affected, including production, distribution and cost of hardware.

- Physical games discs for the American market are predominantly made in Mexico. Potential tariffs on discs produced in Mexico could influence publishers to both decrease the amount of disc games that get released, or move to an all-digital release strategy.[79]

- Some production changes have already been announced as a result of tariffs. META announced that it will move half of its Quest VR headset production to Vietnam from China to avoid tariffs. The change will occur over several years.[80]

Government Support

- In May 2023, Screen Australia unveiled a new initiative called the First Nations Game Studio Fund, which provides support to studios operating under First Nations leadership and ownership control, and specifically targeting established companies who are invested in cultivating culturally safe places for skills development for First Nations gaming professionals.[81]

- France announced that it had extended its video game tax incentives until 2028. The tax credits will be undergoing a modernization, with an increased focus on the creation of new IP, technological innovations, as well as projects related to European identity.[82]

- The Canada Media Fund, the Conseil régional Nouvelle Aquitaine, and the Conseil départemental de la Charente announced a new incentive to fund the co-development and co-production of VR and AR projects between Canadian and French production companies.[83]

- Ontario interactive digital media producers have access to public funding through the Ontario Interactive Digital Media Tax Credit (OIDMTC) and the Ontario Creates Interactive Digital Media (IDM) Fund. Ontario Creates support provides opportunities for producers of interactive content to create new products, access existing and new markets and grow their business. The programs have been streamlined and now includes a screen based Intellectual Property Fund (IP Fund), which features both a linear content and interactive content streams. Other streams include the Global Market Development, Commercialization and Discoverability and Industry Development, which provides support to trade organizations for events and activities that stimulate the growth of the industry. As part of the Industry Development program, the IDM Fund also supports emerging digital companies with training activities through the IDM Fund: Futures Forward initiative.

- Ontario Creates has announced a new content creation IP Fund. The IP Fund is intended to drive economic growth in Ontario’s screen sectors by investing in activities that support the production and exploitation of innovative, high-quality, consumer-focused content. The IP Fund will combine the current Film Fund and Interactive Digital Media (IDM) Fund – Concept Definition and Production programs into a single, integrated program that supports screen-based content creation by Ontario companies. The IP Fund includes two program streams: Linear, for feature film and digital series; and, Interactive, for video games and XR content. Each program stream will support production and development/pre-production activities.

- The Canada Media Fund offers a number of funding programs to support the IDM industry, which can be found under the Experimental category on their website.

Industry Recognition

- Six digital series supported by Ontario Creates, earned a total of 21 nominations at the 2024 Canadian Screen Awards. Winners in the Digital Media Category included:

- Streams Flor From A River, Best Direction, Web Program or Series

- I Hate People, People Hate Me, Best Picture Editing, Web Program or Series

- The Drop, Best Lead Performance, Web Program or Series

- The Drop, Best Lead Performance, Best Supporting Performance, Web Program or Series

- Ontario Creates supported interactive digital media and video games also did well, garnering four nominations and one win, for Survivorman VR, Best Immersive Experience – Fiction.

- The second edition of Toronto Games Week took place from June 12-19, 2024. The weeklong event brought together leaders, developers, publishers, investors, artists, and fans. Some of the events supported by Ontario Creates and Interactive Ontario included IO Connect: Summer Mixer, IO Impact Forum, Indie Superboost Bootcamp and XP Game Summit 2024.[84]

- The Canadian Game Awards returned on February 15th, 2025 at the TIFF Lightbox. The awards are back after a one year hiatus and look to celebrate the best of Canadian gaming across 16 categories. Categories include Game of the Year, Best Game Design, Studio of the Year, Best Debut Indie Game, and Best Technology/Innovation.85

- Ontario Creates-supported video game VENBA received two nominations at the BAFTA Games Awards, won the Seumas McNally Grand Prize at the 2024 Independent Games Festival, and won the Best Debut and the Social Impact Award at the Game Developers Choice Awards.

Profile current as of August 15, 2025

Endnotes

1 ibid

2 ibid

3 Interactive Ontario, Measuring the Impact of COVID-19 on the IDM Industry: Ontario (Revised-Highlights), pg. 1, 11.

4 Interactive Ontario, Measuring Success: The Impact of Interactive Digital Media in Ontario in 2019, pg. 9

5 ibid

6 ibid, pg. 32

7 Statistics Canada, Table 12-10-0116-01 International and inter-provincial trade of culture and sport products, by domain and sub-domain, provinces and territories (x 1,000,000)

8 Interactive Ontario, Measuring Success: The Impact of Interactive Digital Media in Ontario in 2019, pg. 33

9 Alexandra Cutean, Faun Rice, Trevor Quan, Justin Ratcliffe, and Todd Legere (Information and Communications Technology Sector),Ontario’s Next Gen Industry: Addressing Labour Demand and Growth in the Creative Technology Sector, pg. 7

10 ibid, pg.7

11 ibid

12 Entertainment Software Association of Canada, The Canadian Video Game Industry 2024, pg. 3

13 ibid

14 ibid, pg. 9

15 ibid, pg. 9

16 ibid, pg. 8

17 ibid

18 ibid, pg. 14

19 ibid, pg. 24

20 ibid

21 ibid, pg. 18

22 Ibid, pg. 16

23 Ibid, pg. 20

24 ibid

25 Ibid, pg. 25

26 Entertainment Software Association of Canada, The Canadian Video Game Industry 2021, pg. 27

27 ibid

28 Alexandra Cutean, Faun Rice, Trevor Quan, Justin Ratcliffe, and Todd Legere (Information and Communications Technology Sector),Ontario’s Next Gen Industry: Addressing Labour Demand and Growth in the Creative Technology Sector, pg. 43

29 Interactive Ontario, Insights and Best Practices on Scaling up Video Game Companies, pg. 4

30 James Batchelor, “Game investment and M&A deals pull ahead of 2023 at $10.38bn for Q1-Q3”, GamesIndustry.biz, November 21, 2024

31 PwC, Global Entertainment and Media Outlook 2024-2028: Canada, pg. 23

32 ibid, pg. 10

33 ibid

34 ibid

35 ibid

36 ibid

37 Ibid

38 Ibid, pg. 11

39 Entertainment Software Association of Canada, Power Of Play Global Report 2023, pg. 4

40 ibid

41 ibid

42 ibid

43 ibid

44 Sophie McEvoy, “Newzoo: Global games market expected to grow to $187bn in 2024”, GamesIndustry.biz, Aug 13, 2024

45 Sophie McEvoy, “Midia Research: Global games industry estimated to reach $236.9bn in 2025”, GamesIndustry.biz, Mar 20, 2025

46 ibid

47 ibid

48 ibid

49 PwC, Global Entertainment and Media Outlook 2024-2028: Global, pg. 16

50 ibid, pg. 21

51 ibid

52 ibid, pg. 11

53 Ibid

54 Video Game Insights, Global Indie Games Market Report 2024, pg. 4

55 Entertainment Software Association of Canada, Beyond Entertainment: The Transformative Power of Video Games, pg. 3

56 Ibid, pg. 22

57 Ibid

58 Ibid

59 ibid

60 Ibid

61 Ibid, pg. 23

62 ibid

63 ibid

64 Entertainment Software Association of Canada, The Canadian Video Game Industry 2024, pg. 31

65 Game Arts International Network, If You Don’t Like The Game, Change The Rules: Alternative Modes of Videogame Production, pg. 15

66 Ibid, pg. 33

67 ibid

68 Niall Firth, “How generative AI could reinvent what it means to play”, MIT Technology Review, June 20, 2024

69 ibid

70 ibid

71 ibid

72 Scott j Mulligan, “What impact will AI have on video game development?”, MIT Technology Review, September 10, 2024

73 Scott DeJong, Michael Iantorno, “How gig platforms like Fiverr are reshaping the video game development industry”, theconversation.com, January 5, 2025

74 Nicole, Carpenter, “2024 has already had more video game industry layoffs than all of 2023 — and it’s only June”, polygon.com, June 13, 2024

75 Megan Farokhmanesh, “2024 Was the Year the Bottom Fell Out of the Games Industry”, wired.com, December 20, 2024

76 ibid

77 ibid

78 Communication Works of America, Video Game Workers Launch Industry-Wide Union with Communications Workers of America, March 19, 2025

79 Kyle Orland, “Due to new tariffs, many more physical game discs may “simply not get made””, arstechnica.com, March 5, 2025

80 Mark Campbell, “Meta’s moving half of Quest VR headset production out of China”, overclock3d.net, December 6, 2024

81 Marie Dealessandri, “Screen Australia launches First Nations Game Studio fund”, GamesIndustry.biz,, May 9, 2023

82 Marie Dealessandri, “French games tax relief scheme extended to 2028”, GamesIndustry.biz,, November 18, 2022

83 Canada Media Fund, “Canada and France launch new joint incentive for virtual and augmented reality projects”, May 24, 2023

84 Interactive Ontario, “Ontario’s Biggest Video Game & XR Industry Week”, interactiveontario.com , June 21, 2024

85 Dennis Price, “The 2025 Canadian Game Awards Nominees Announced”, Consolecreatures.com, January 16, 2025