Industry Profile - Magazine

June 2023 Profile

Introduction

Canada’s magazine sector includes consumer and business-to-business (B2B) brands, with content distributed both in print and digitally, via a variety of web and mobile channels. Business models in the magazine industry increasingly incorporate a range of revenue streams beyond traditional subscription and advertising, such as custom publishing, events-based and retail-based revenue generation strategies.

Industry Size and Economic Impact

Note: The following information on revenue, employment and the consumer market should be considered a snapshot of activity in the industry based on the best available information.[1] All dollar figures are in CAD unless otherwise noted.

Revenues and Related Figures

- According to Statistics Canada, the Canadian periodical publishing sector generated revenues of almost $983 million in 2021, with an operating profit margin of 9.3%.[2] For its part, Ontario represented approximately 58% of all operating revenues in 2021 ($574 million), and the provincial operating profit margin was 8.5%.[3]

- Ontario’s periodical publishing industry contributed $467 million to Ontario’s GDP in 2020.[4]

- Broadly, revenues from the periodical publishing sector have been declining for a number of years. From the period of 2013-2021, national operating revenues have declined by 50%, from $1.97 billion to $983 million.[5]

- According to PwC, the consumer print magazine segment of the Canadian marketplace has seen its issues exacerbated by the COVID-19 pandemic with revenues declining by 22% in 2020, and anticipated to continue to decline at a 3.3% CAGR through to 2026.[6]

- While not sufficient to compensate for the decline in consumer print revenues, consumer digital magazines are expected to reach $332 million USD in revenues by 2026, and grow at a 1.9% CAGR.[7] As a result, the total consumer magazine market is predicted to decline to $750 million USD by 2026, a CAGR of -1.2%.[8]

- Advertising remains the most important revenue source for Canadian magazine publishers. In 2021, advertising revenue accounted for 50% of all sales by Canadian magazine publishers, followed by circulation sales (36%), and custom publishing (4%). The remaining 6% is attributable to customer publishing and printing, events, and distribution services.[9]

- Revenues follow similar trends for Ontario magazine publishers. Of the total $435.2 million in sales revenues generated by Ontario magazine publishers, $218 million (50%) came from sales of advertising, $198.5 (46%) million from circulation sales, and an additional $18.7 million (4%) from custom publishing.[10]

- Broadly, however, the revenues generated from advertising, circulation and custom publishing have declined by 61% at the national level over the period of 2013-2021.[11] For Ontario magazine publishers, revenues from these same sources has declined by 50% over the same period. Specifically, advertising revenues declined by 62%, circulation revenues declined by 35% and custom publishing revenues declined by 24%.[12]

- For both Canada and Ontario in 2021, advertising was the largest source of sales revenues attributed to digital products, with 68% and 66% respectively.[13]

- In that same year (2021), sales of controlled or requested circulation accounted for 57% of print circulation revenues in Canada (41% in Ontario), followed by free or promotional copies (24% in Canada, 19% in Ontario), paid subscriptions (23.7% in Canada, 19% in Ontario) and newsstand (11% in Canada, 6% in Ontario).[14]

- Across Canada, the proportion of print circulation revenues from paid subscriptions and newsstand sales are declining in favour of controlled circulation. For magazines published in Ontario, the share of both print circulation revenues achieved by paid subscriptions and newsstand sales has declined since 2013.[15]

- The majority of magazine titles published in both Canada (71%) and Ontario (68%) are consumer magazines. For its part, B2B, trade and professional magazines represented approximately 30% of the titles published in Canada, and 32% of the titles published in Ontario.[16] However, the share of B2B titles is growing and particularly so in Ontario, where the share of B2B magazines increased from 12.4% in 2017 to 32% in 2021.[17]

- The majority (58%) of magazine titles published in Canada in 2021 were distributed both in physical and digital formats. Print-only titles accounted for 31% of all published titles, followed by digital-only titles at 11% of the market.[18]

- Over the period of 2014-2019, the total number of magazine titles has declined across all categories.[19]

Employment and Wages

- In 2020, Ontario’s periodical publishing industry accounted for 3,572 jobs.[20] Between 2016 and 2020, the total number of jobs in Ontario fell by 24%.[21]

- In 2021, the Ontario periodical publishing industry spent over $207 million on salaries, wages, commissions and benefits. This marks a 44% decrease from $369 million in 2013.[22]

- According to Magazines Canada, on average, every $75,000 in lost revenue at a Canadian magazine publishers will cost 1 job.[23]

Consumer Market

- According to recent data collected by Vividata, magazines reach 79% of adults in Ontario and Quebec.[24] On average, 65% of adults access a print or digital magazine on a monthly basis.[25]

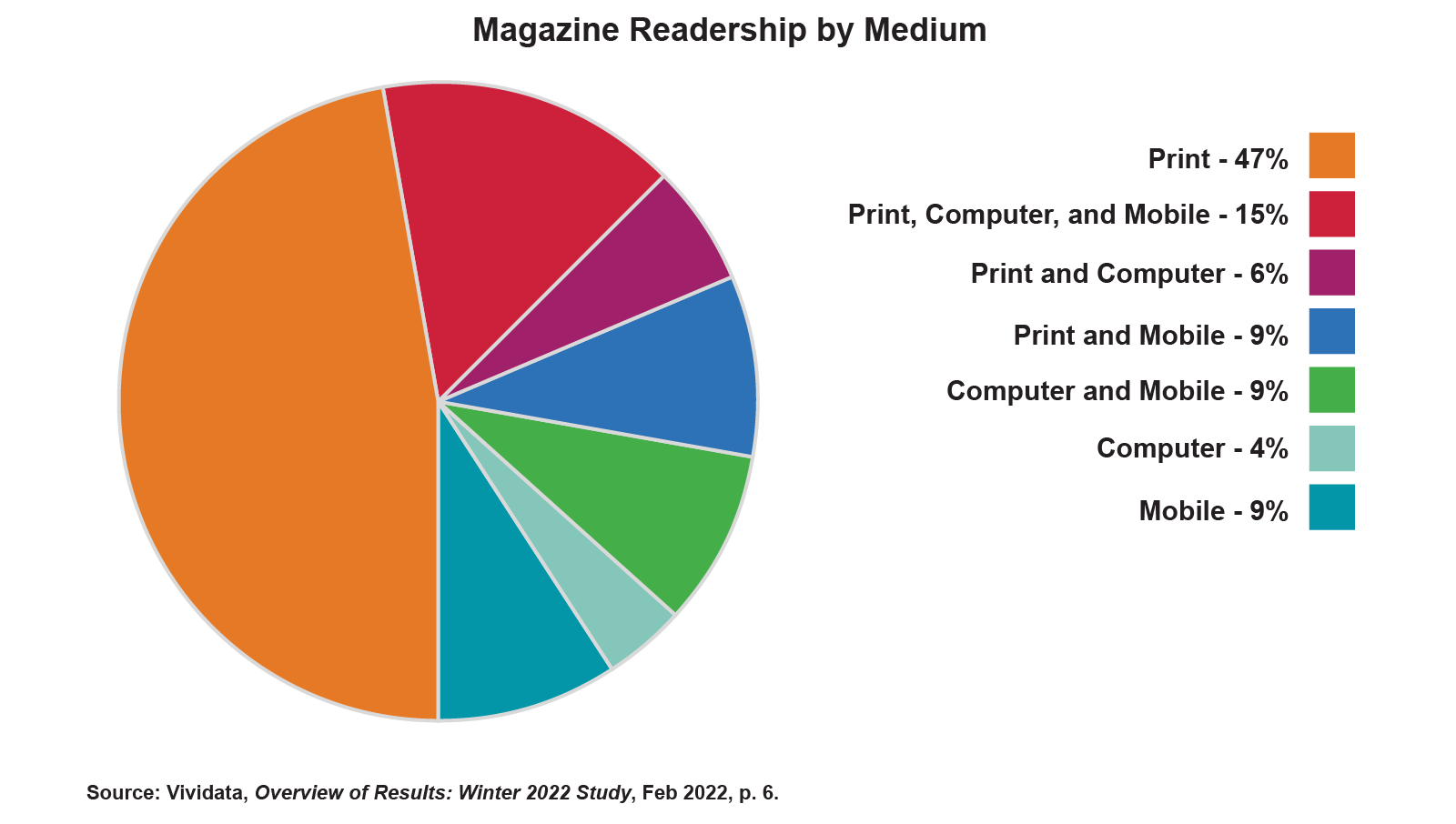

- In Canada, digital magazines are most commonly accessed via smartphones (22%), and that percentage increases to 44% for individuals under 35 and 57% for newcomers.[26] Meanwhile, 42% of magazine readers only read the print version, while 17% do so in combination with more than one digital device.[27] Notably, readers under 55 mainly access digital magazine content indirectly, though search or social media links.[28]

- The most popular magazine categories in Canada are food, travel and health magazines, followed by home décor, entertainment/celebrity and technology/science publications.[29]

- According to the Association of Magazine Media’s Factbook 2021, 88% of U.S. adults have read a magazine in the last six months (print and digital editions), as have 90% of adults under the age of 25.[30] Notably, in the U.S., the top 25 magazines reach more adults than the top 25 primetime shows.[31] In particularly, magazines also outperform top tech sites in terms of reaching women 18+.[32]

- To some degree, the COVID-19 pandemic may have led more U.S. consumers to engage more deeply with magazines, with 76% of magazine readers indicating reading magazines was a nice break from screens, and 68% indicating that they appreciated print magazines more (44% for digital).[33]

Trends and Issues

Some of the current key trends in the magazine publishing industry are ongoing discussions of print vs. digital media, new methods to engage readers, subscription models, environmental sustainability, and diversity.

Growth Rate and Industry Trends

- Globally, total consumer magazine revenues will decline at a -2.1% CAGR to $53.7 billion USD by 2026.[34] Effectively, PwC explains that magazine publishers are projected to lose $6.1 billion in revenues from 2021-2026.[35] The decline is being driven by losses in the print advertising portion of the market, which is expected to decline rapidly at a 8.9% CAGR to $7.4 billion USD in 2026.[36] For its part, digital advertising segment is projected to rise at a 4.2% CAGR to $8.3 billion over that same period.[37]

- PwC anticipated that the global decline in print circulation revenues will be held to -2.3% CAGR, falling to $32.7 billion in 2026.[38] Global digital circulation revenues are expected to rise at a 3.3% CAGR to $5.2 billion in 2026, but will still only account for 13.8% of total circulation revenues.[39]

- Broadly, PwC highlights that magazine publishers are struggling to replace significant decline in traditional revenues with new revenue models at scale, as large tech companies like Google and Facebook continue to dominate when it comes to advertising spend.[40]

- The sector has also been impacted by the phasing out of the third-party cookie, which are tracking codes placed on a website (by someone other than the owner of the website) to track user behavior across the internet, and used to develop highly customized and specific advertising.[41] Third-party cookies have long been an integral part of digital marketing, and the economic impact of the end of third-party cookies on publishers has been estimated as losses of up to $10 billion in advertising revenues.[42]

- In response to these developments, some have advocated for publishers to move towards building their own first-party data strategies and data collection infrastructure, using contextual marketing techniques, or building strategic partnerships to spur collaboration and share data.[43] In Canada, some recent examples of strategic partnerships include a recently announced partnership where Cottage Life (Blue Ant Media) has become the official media sponsor for the Tall Pines Music & Arts Festival across multiple platforms (the magazine, CottageLife.com, bi-weekly e-newsletters, a podcast, and on social media platforms) as well as on-site activations at the festival.[44]

- With three of the world’s largest companies (Google, Facebook, and Amazon) accounting for 60% of global ad revenue, magazine publishers both globally and within Canada continue to experiment with a variety of revenue models, including digital subscriptions, e-commerce platforms, memberships, e-learning, and events.[45]

- A recent report from FIPP highlights how global magazine publishers are using paywalls as part of their digital subscriptions strategy. The survey conducted in partnership with CeleraOne, surveyed 95 publishers across 11 countries in order to benchmark paywall activity. The data highlights a slight preference towards intelligent paywalls, with 45.3% of respondents using them, compared to 39% using a simple paywall and 15.8% using both types.[46] The report also highlights the advantage of intelligent paywalls when it comes to being able to collect a large number of personalized details about readers. [47] For example, the Wall Street Journal’s intelligent paywall collects user activity across 60 different variables, including frequency, recency, depth of read, content preferences, and favoured devices. These variables contribute to calculating a “propensity score” that estimates the probability of a reader to subscribe to the publication.[48] In turn, the Wall Street Journal can then adapt the paywall to place limits on free stories that are within the areas of the readers’ interests.[49]

Global and Domestic Issues

- Sports betting has emerged as a revenue and reader engagement opportunity, albeit controversially. [50] Several major global sports-oriented publications like Sports Illustrated, Barstool Sports, and Vox Media, among others, have entered into lucrative partnerships with betting and gaming companies as regulatory bans on sports betting have been lifted across multiple jurisdictions.[51] In Canada, The Hockey News announced a multi-year partnership to make BETMGM become their exclusive betting partner in 2021, which will involve the creation of print and video content offering unique insights from a betting perspective.[52]

- Global awareness and concern around climate change and sustainability continues to generate interest within magazine publishing. Many of the world’s largest magazine publishers have made high-profile commitments, including Condé Nast who has committed to becoming carbon-neutral by 2030, and Axel Springer who has committed to all avoidable emissions being reduced by 90% by 2045.[53] There is also a significant consumer interest in becoming environmentally-friendly, with new research from Deloitte and NewYouGov highlighting that consumers have become increasingly committed to taking action on climate change.[54]

- A 2021 study commissioned by the Alberta Magazine Publishers Association (AMPA) and the Magazine Association of BC surveyed magazine publishing companies and individuals across Canada (in French and English) to learn more about equity, diversity and inclusion in the industry. The study found that 45% of respondents felt that the industry was not inclusive or equitable, and that broadly, people from equity-seeking groups and working at smaller organizations were less likely to feel that the industry was inclusive and equitable.[55]

- While the impact on Canadian magazine publishers remains to be seen, Amazon announced that it would be discontinuing its Kindle Publishing for Periodicals Program as of September 2023.[56] This service was offering digital and physical magazine and newspaper subscriptions and single issues for the US and three other markets.[57]

Government Support

- The Canada Periodical Fund (CPF), administered by the Department of Canadian Heritage (DCH), offers funding to eligible magazine publishers for content creation, distribution, online activities, and business development. It also provides support for business innovation projects and collective initiatives that strengthen the Canadian magazine sector. The Fund also includes a Special Measures for Journalism stream that provides financial support for eligible Canadian print or digital magazine publishers operating with a free circulation model or low levels of paid circulation to help them overcome market challenges.

- Ontario magazine publishers currently have access to public funding through the Ontario Creates Magazine Fund. Ontario Creates also provides funding to trade and event organizations in the province’s magazine sector through the Industry Development Program for events and activities that stimulate the growth of the industry. In some cases, magazine publishers may be eligible for the Ontario Creates Interactive Digital Media Fund.

Industry Recognition

- Ontario magazines were well-represented at the 2023 National Magazine Awards. Among these were The Walrus, Cottage Life, Inuit Art Quarterly and the Literary Review of Canada who won Gold and Silver across numerous categories. At the NMA: B2B awards, both Precedent (Gold) and Azure Magazine (Silver) won awards, while at the Digital Publishing Awards, the Walrus (Gold) and C Magazine (Honourable Mention) were winners.

Profile current as of June 16, 2023

Endnotes

1 Ontario Creates relies on the most recent Statistics Canada data releases to compile this profile. There is a period of time needed for Statistics Canada to collect the data (e.g. receipt of income tax returns) and compile the data releases.

2 Statistics Canada,, Table 21-10-0053-01, Periodical publishers, summary statistics, (Accessed June 14, 2023)

3 ibid

4 Statistics Canada, Table 36-10-0452-01, Culture and sport indicators by domain and sub-domain, by province and territory, 2020, product perspective (x 1,000), released June 2, 2022.

5 Communications MDR, An Environmental Scan of the Canadian Magazine Industry, pg. 14

6 PwC, Global Entertainment & Media Outlook 2022-2026: Canada, pg. 15

7 ibid

8 ibid

9 Communications MDR, pg. 16

10 Communications MDR, pg. 17

11 ibid

12 Communications MDR, pg. 18

13 Communications MDR, pg. 19

14 Communications MDR, pg. 21

15 Communications MDR, pg. 22

16 Communciations MDR, pg. 23

17 ibid

18 Communications MDR, pg. 24

19 Media at the Crossroads, The Digital Media Universe: Measuring the Revenues, the Audiences and the Future Prospects, pg. 72

20 Statistics Canada, Table 36-10-0452-01, Culture and sport indicators by domain and sub-domain, by province and territory, 2020, product perspective (x 1,000), released June 2, 2022.

21 Communications MDR, pg. 26

22 Statistics Canada. Table 12-10-0116-01 International and inter-provincial trade of culture and sport products, by domain and sub-domain, provinces and territories (x 1,000,000), released October 4, 2022.

23 Magazines Canada, Supporting the Canadian Magazine Publishing Sector: A Pillar of Canada’s Democracy, pg. 6

24 Patti Summerfield, “Magazines and newspapers still reach a vast majority of Canadians”, Media in Canada, April 4, 2023

25 ibid

26 ibid

27 ibid

28 ibid

29 ibid

30 MPA – The Association of Magazine Media, 2021 Factbook, p. 45

31 Ibid, pg. 11

32 Ibid, pg. 10

33 Ibid, pg. 16

34 PwC, Global Entertainment & Media Outlook 2022-2026: Global, pg. 28

35 ibid

36 Ibid, pg. 29

37 ibid

38 ibid

39 ibid

40 Ibid, pg. 28

41 UPM & FIPP, Media’s Future in a Post-Covid World, pg. 13

42 Ibid, pg. 14

43 ibid

44 Patti Summerfield, “Cottage Life signs on as media sponsor of cottage country festival”, Media in Canada, May 19, 2023

45 UPM & FIPP, pg. 19-24

46 FIPP, A Deep Dive into Digital Subs, pg.7

47 ibid, pg.8

48 WNiP, “Intelligent Payment: the “hottest new tool” helping publishers secure sustainable reader revenue”, What’s New in Publishing, May 14, 2019.

49 ibid

50 Adrian Ghobrial, “’Society let him down’: grieving mother says in warning about sports betting ads”, CTV News, December 15, 2022

51 Faisal Kalim, “Is sports betting emerging as the new revenue and reader engagement opportunity for publishers?”,What’s New in Publishing, September 16, 2022

52 The Hockey News, “BetMGM Named Exclusive Sports Betting Partner of the Hockey News”, The Hockey News, June 3, 2021

53 FIPP, Global Media Sustainability Tracker, accessed on June 16, 2023

54 ibid

55 Zenev and Associates, The State of Diversity, Inclusion and Equity in the Canadian Magazine Industry: Survey Report (Summary), pg. 3

56 Jim Milliot, “Amazon to end print textbook rentals, overhaul magazine and newspaper subscriptions”, Publishers Weekly, December 14, 2022

57 ibid