Industry Profile - Book

October 2025 PROFILE

Introduction

Book publishing in Canada is a $1.4 billion industry, with Ontario contributing almost two-thirds of total national operating revenue at $980 million. The Ontario publishing ecosystem includes large, foreign-owned publishing firms as well as smaller, Canadian-owned publishers.

Industry Size and Economic Impact

Note: The following information on employment, revenue and the consumer market should be considered a snapshot of activity in the industry based on the best available information. Many of the figures for Canadian-owned publishers contained in this profile include a very small number of large corporations whose characteristics differ significantly from those of small- and medium-sized book publishers. All dollar figures are in CAD unless otherwise noted.

Employment, Wages and Demographics

- In 2023, the Canadian book publishing industry generated 9,922 jobs, a 4.5% increase from 2022. Book publishing jobs in Ontario accounted for 64% of the national total, representing 6,396 jobs.[1]

- In 2022, salaries, wages, commissions and benefits for Canadian book publishers accounted for 23% of operating expenses, with a total of $378.2 million.[2] Ontario accounted for over $236 million (or 62%) of national wages, salaries and benefits in 2022.[3]

- According to survey data collected by BookNet Canada, Canadian publishers had an average of 28.9 full time, and 8.2 part-time employees in 2023.[4] The Canadian publishers who were [5]included in this study represented approximately 54% of the English-language print book market, with 63% of respondents being small publishers (revenues of less than $999,999), 27% being mid-sized publishers (revenues between $1 million and $9,999,999) and 10% being large publishers (revenues of $10 million or more).[6] BookNet’s data also suggested that staff make-up stayed flat for the majority (56%) of publishers between 2022-23, while staff count increased for 37% of publishers and decreased for just 7% of publishers.[7] Mid-sized publishers were the most common type to see an increase in staff with 63% reporting an increase.[8]

- A 2024 report by the Association of Canadian Publishers (ACP) examined salaries in the Canadian book publishing industry. Among respondents, the most common firm sizes were 0–5 employees (20.4%), 6–15 employees (17.8%), and 16–25 employees (20.2%), collectively representing nearly 60% of all Canadian publishers.[9]

- In 2024, the average salary for all positions was $64,580.[10] At the high end, the average salary for a Publisher/VP Publishing/Publishing Director was $88,000.[11] As a whole, salaries increased on average 20-25% since the last time this survey was conducted which was in 2018.[12]

- On average, salaried employees earned in the range of $40,000 - $59,000 annually, except for executive-level staff who earned $60,000-$69,000 on average.[13]

- Looking at types of employment, 81.1% of respondents were full-time employees, while freelancers accounted for 7.4%, part-time 5.6% and contract employees at 3.9%.[14] Looking at previously collected data, there was a decline in the number of full-time staff during and immediately after the COVID-19 pandemic. In 2018, 85% of respondents reported being fulltime, which dropped to just over 70% in the 2022 results, but has since recovered to more than 81% in 2024.[15]

- Demographic data was also collected as a part the study. Based off respondents, the book publishing industry is mostly comprised of women (79%) who identify as white (79%).[16] Heterosexual individuals make up 61% of employees[17], and most individuals who work in the sector are between 30-49 years of age (54.6%)[18].

- In terms of the location of where individuals work, Ontario was by far the most popular region/province, accounting for 60.7% of all employees, with British Columbia (15.1%) coming in second and Prairies (10.4%) coming in third. Of those who reported working in Ontario, 42% live in the Greater Toronto Area.[19]

- In 2023 as part of a national survey by Booknet, they asked employers about remote work. The majority of respondents (68%) had staff who use a hybrid model, both in-person and at home. All large publishers used a hybrid model, as well as 82% of mid-sized publishers. Small publishers had the largest percentage of workers who only worked remote at 23%, followed by mid-sized at 18%.[20]

Revenues and Related Figures

Note: Unless otherwise indicated, the following figures include all book publishers in Canada, including both domestically-owned and foreign-owned.

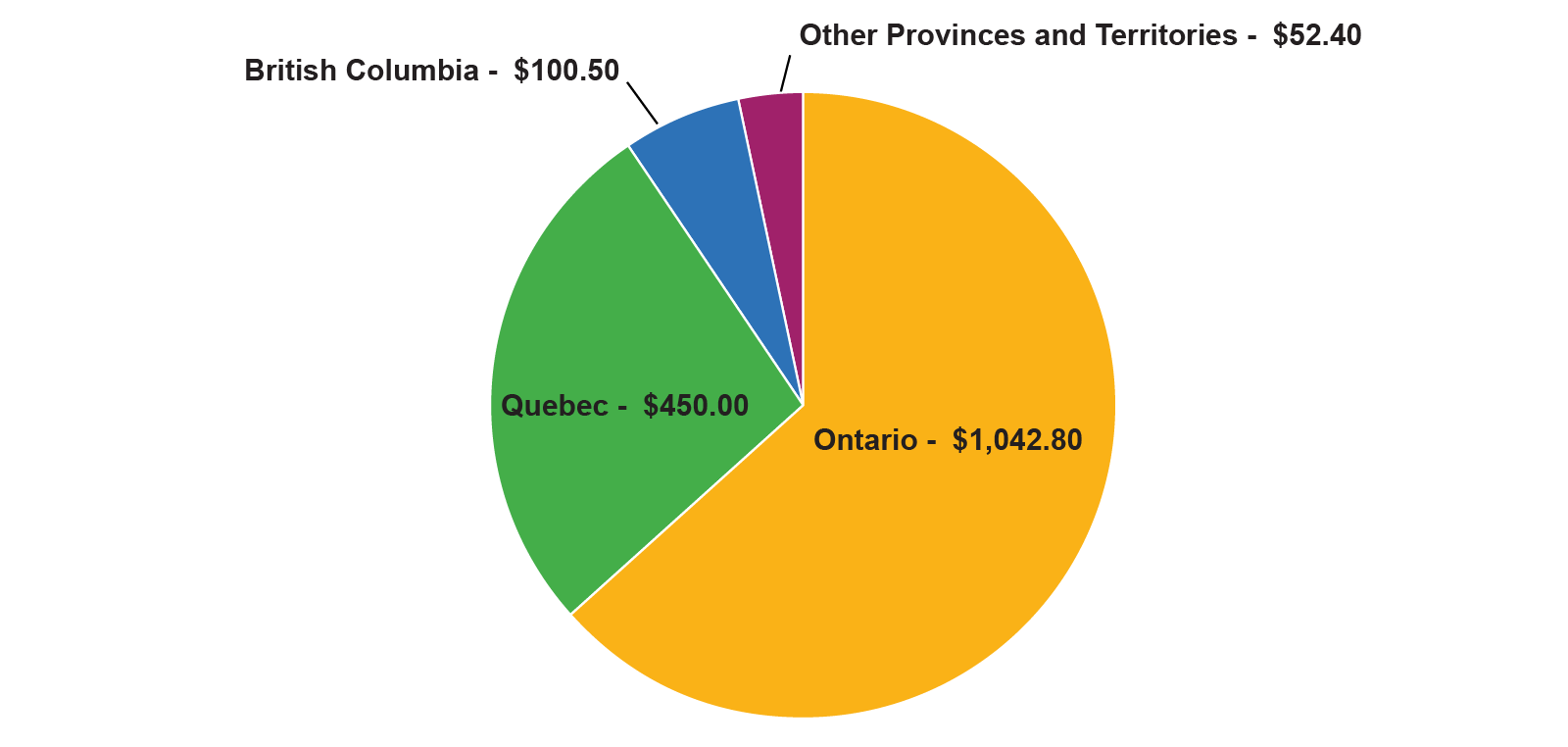

- In 2022, the Canadian book publishing industry generated operating revenue of $1.64 billion, an increase of 8% from 2020. Both operating revenues and operating expenses increased by 8% and 13% respectively, resulting in a flat operating profit margin of 9.9% in 2022 compared to 10% in 2012.[21]

- The Ontario book publishing industry’s share of these operating revenues is valued at $1.04 billion (representing 63% of the national figure), which is a 2% decrease from 2020.[22] Both operating revenues ($1.04 billion) and operating expenses ($960 million) increased at a rate of 6%, but actually resulted in a slightly decreased operating profit margin of 8.0% in 2022, compared to 8.3% in 2020.[23]

Book Publishing Operating Revenue, 2022 (x1,000,000)

Source: Statistics Canada, Table 21-10-0200-01 – Book publishers, summary statistics. (Released February 19, 2024).

- The Canadian book publishing industry generated $1,065 billion in GDP in 2023, up from $969 million in 2022. Of that $1,065 billion, $751 million is attributable to GDP generated in Ontario.[24]

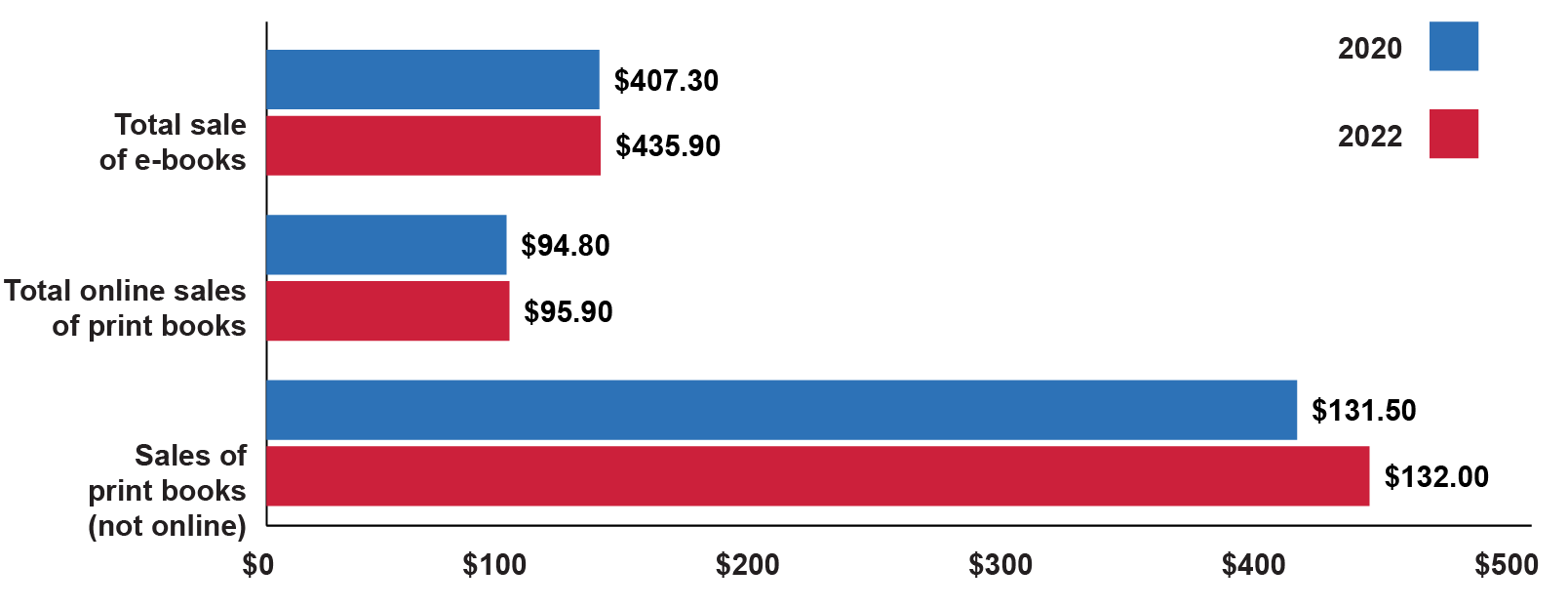

- In 2022, total book sales in Canada represented $998.3 million. Of that total, print books (including wholesalers, bookstores and general retailers) represented 70% of all sales, while sales of e-books accounted for 15% and online sales of print books accounted for 16%.[25]

- In 2022, total book sales in Ontario generated $663.8 million dollars, with the total sales of print books not online accounting for $435.9 million (66%), e-books accounting for $132 million (20%), and the online sales of print books accounting for $95.9 million (14%). Total sales of print books (not on the internet) have been on the decline since 2016.[26]

- According to BookNet’s The State of Publishing in Canada 2023 report, the majority of publishers saw a marginal increase of revenue. 42% of publishers saw revenues increase up to 25%, while half of all large publishers who responded to the survey saw a decrease of up to 10% of revenues.[27] Note: most respondents (63%) to this study were small publishers with gross revenues of less than $1 million in 2023.

- According to mid-year data for 2024, the Canadian trade print book market sold 20,772,885 units for a value of approximately $477 million the first six months of 2024, which was primarily flat compared to 2023.[28]

Consumer Market

Book Publishing, Net Value of Book Sales in Ontario, 2020-2022 (x1,000,000)

Source: Book publishers, net value of book sales by customer category (x 1,000,000) (Released February 19, 2024)

- According to the BookNet Canadian Book Consumer survey, 49% of respondents bought new books and 27% borrowed books from the library monthly.[29]

- Paperbacks remain the most popular book format purchase, representing 49% of the books purchased in 2024 while hardcover represented 26%.[30]

- When asked how they purchased a book in 2024, 54% of buyers said they used an online website, 46% used a retailer in person.[31]

- According to BookNet, the major ways book buyers become aware of books in 2024 were through reading other books by the same author/illustrator (20%), browsing either online or in person (19%), or through recommendations and reviews (19%).[32] When buying books in-store, Canadian book buyers were most likely to find the book they purchased on the main shelf (53%), while 39% of online consumers first found them by searching for a particular book.[33]

- In 2024, Canadian book buyers bought an average of 3.6 books per month, which broke down to 2 print books, 1 eBook and 0.5 audiobooks.[34] Overall, 15% of the books purchased by Canadian buyers were eBooks and 6% were audiobooks.[35]

- In terms of willingness to explore Canadian content, 32% of book buyers said they searched for books by Canadian authors or illustrators, 27% sought out books about Canada or regions within Canada, 22% sought out books about a group or culture written by people from that group or culture.[36]

- In 2024, more Canadians visited the library online or in person than ever before. Since 2020, book borrowers who visited the library online at least once a month has increased year over year and peaked in 2023 at 86%. Looking at in person visits, the numbers have also been growing steadily and 90% of book borrowers visited a library in 2024, up from 59% in 2020.[37]

- The consumption of audiobooks from libraries continues to increase. In 2024, 38% of all digital library checkouts were audiobooks, and has increased 133% since 2019.[38]

- While the average costs of buying books has steadily increased over the years, prices decreased from 2023 to 2024. The average price paid by Canadian book buyers decreased 7% for eBooks, 7% for hardcovers, 11% for paperbacks and 12% for audiobook when looking year over year.[39]

Trends and Issues

The growth rate of the Canadian book industry is positive according to statistics and will continue on a slight upward trend, according to forecasts from PwC, with electronic consumer books set to grow more rapidly than print and audio formats. COVID-19 has had a number of impacts on the publishing industry that are likely to continue post-pandemic. Diversity, accessibility and environmental sustainability all continue to be important issues in the publishing industry.

Growth Rate and Industry Trends

- According to PwC, Canada’s consumer books market was valued at USD $791 million in 2023, and revenues are expected to rise at a 1.3% CAGR annually, to USD 843 million 2028.[40]

- Revenues associated with print books are expected to rise at a 0.2% CAGR, and print currently makes up the bulk of the Canadian market (65.5% of revenues in 2023).[41] Revenues from e-books will rise faster over the same period (3.1% CAGR), and will make up 38% of the market in 2028.[42]

- In the first half of 2023, juvenile and young adult books dominated print sales of English language titles compared to 2022, accounting for 40% of all books sold, while non-fiction came in second with 31% of total sales.[43]

- While the Canadian audiobook market is growing, in 2023 Spotify launched their pay-per-book program, which will be another revenue source and a competitor to Audible and Kobo.[44] In July 2025, following trials in Canada and Ireland, Spotify has rolled out their Audiobooks+ subscription add on service to 11 more markets, allowing uses to pay $14.99 for 15 additional hours of audiobook listening time.[45]

- Globally, the consumer book market has seen year on year-on-year growth of 1.3% from 2022 to 2023, and is poised to grown close to USD $67 billion by 2028.[46]

- Social media continues to be a strong influence with TikTok, YouTube and Instagram leading the charge of book related content, with BookTok, BookTube and Bookstragram communities that can help drive sales. [47]

- In 2024, BookNet conducted a Leisure & Reading study on the reading habits of Canadians. The overall results show that daily reading has gone up 5% from 2023-2024 with 43%, and is ranked higher than exercise in terms of daily activities.[48] Almost half (45%) of readers read between one and five books and 45% make reading a shared activity, by reading all or part of a book to another person.[49]

Global and Domestic Issues

- In May 2025 after the recent Canadian federal election, newly elected MP Evan Solomon was sworn in as the first Minister of Artificial Intelligence and Digital Innovation. While a set of bills that were to be introduced by the previous government including the Artificial Intelligence and Data Act have been shelved, the regulation of artificial intelligence in Canada has yet to be determined.[50]

- With the use of copyrighted works used to train generative artificial intelligence programs, over 8,000 authors have signed an open letter from the Authors Guild for companies to obtain permission before using any copyrighted work in their models. One of the options put forth by the Authors Guild is a form of collective licensing that would pay creators for works that AI developers have already been using.[51]

- Presently the US Copyright Office is currently undergoing its study on copyright and AI which began in 2023. Part 3 of the draft of the Generative AI Training report touches on key issues around the use of copyrighted materials in training AI models. It specifically looks at the legality of training and developing AI systems under copyright law and the rights of copyright owners whose works are used to develop these systems.[52] The report examines fair use in the context of AI training and that context and usage are key components as to what qualifies as fair use.[53]

- Authors have attempted to take legal recourse against artificial intelligence training and copyrighted materials used for large language models. In a recent pre-trial ruling, one of the first on the topic, a US federal judge in California found that while using legally acquired copyrighted books to train AI large language models constitutes fair use, downloading pirated copies of those books for permanent storage violates copyright law.[54] While the initial ruling by the judge was that the usage of the works was fair use, it was determined that the practice of using pirated materials was not covered by fair use and thus allowed for the suit to proceed.[55]

- In early September it was announced that a $1.5 billion USD settlement had been agreed to between Anthropic and book publishers. This is the largest copyright settlement in US history. The agreement, once finalized, will pay approximately $3,000 USD for each of the almost 500,000 books covered in the settlement by the lawsuit.[56]

- In a first, a Canadian author, J.B. MacKinnon has recently filed four proposed class action lawsuits against four major technology companies. The author has claimed his works were illegally used in the development of large language models. The suit seeks for numerous actions including an injunction to prevent the companies from continuing to infringe on copyrights by Canadian authors[57]

- The prevalence of AI generated books is becoming increasingly commonplace. While scam books have been an issue on online storefronts like Amazon, AI is making it easier to generate them. In 2023 an author, who writes about the publishing industry, found that five new titles were listed for sale under her name, even though she didn’t write them. To remove published work from Amazon, they require proof of copyright or trademark infringement, which were not an issue in this case. After much pushback the titles were removed.[58]

- In early 2025 United States President Trump announced 25% tariffs on goods from Canada and Mexico, and Canadian book publishers have faced mounting costs on the proposed 25% tariff. Some publishers tried to take a proactive approach and move inventory across the border in advance of the tariffs being enacted, while others thought about absorbing the costs.[59]

- The ongoing of threats of tariffs from the United States have caused increased concern, especially regarding costs and sales among publishers. While no tariffs have targeted book publishers yet, the threat is still very much a concern. According to the Association of Canadian Publishers, the majority of books in Canada are imported and tariffs would have a large effect on the industry.[60] That being said the majority of independent Canadian publishers print, publish and warehouse in Canada, and a tariff on Canadian books could lead to a limited supply of Canadian printers, as multinationals have moved production out of Canada in recent decades.[61]

- Many Canadian publishers send their books to the U.S. distributors to be sold on consignment, while other Canadian publishers earn more than half of their revenues from business in the United States. [62]

- In late August 2025, the Prime Minister announced the removal of most counter tariffs placed on goods from the United States.[63] While businesses are the ones initially paying the higher costs of goods, at least some of the costs have been passed along to consumers. Based off of the 2018 tariff dispute, around 75% of the costs of the tariffs were passed along to consumers over an 18-month period.[64]

- Canadian print readers have shown a growing preference for environmental considerations around their books. Over 70% want books from sustainably sourced materials, 69% donate or give away their books when they have completed them, and half are interested in knowing both where their books are printed or shipped from.[65]

Government Support

Note: The information included in this section is an overview of some of the government support to the book publishing sector. This is not intended to be a comprehensive list of government support available.

- The Department of Canadian Heritage provides funding to the Canadian book industry through the Canada Book Fund (CBF), with two major streams: Support for Organizations and Support for Publishers. The Support for Publishers stream includes Business Development and Publishing Support streams.

- A new campaign from the Association of Canadian Publishers is asking the federal Department of Canadian Heritage to meet its currently unfulfilled 2021 election commitment to increase the Canada Book Fund budget by 50%.[66]

- Ontario publishers have access to provincial funding through several Ontario Creates programs and a tax credit: the Book Fund, the Global Market Development Fund and the Ontario Book Publishing Tax Credit (OBPTC). Through its Industry Development Program, Ontario Creates also provides support to book industry organizations for events and activities that stimulate growth of the industry, including the educational market.

- Other funding mechanisms at the federal and provincial levels include the Canada Council for the Arts and the Ontario Arts Council (with the Literary Creation Projects grants, the Literary Organization Projects grant, the Literary Organizations: Operating grant and the Publishing Organizations: Operating grant).

Industry Recognition

Ontario authors and publishers are frequently lauded for their outstanding work:

- The Trillium Book Award / Prix Trillium, administred by Ontario Creates, encourages excellence in literature by investing in Ontario-based writers. Ontario Creates is proud to announce the winners of the 2025 Trillium Book Awards, honouring four Ontario authors with the province’s most prestigious literary prize.

- Trillium Book Award: I'm So Glad We Had This Time Together, Maurice Vellekoop (Random House Canada / Penguin Random House Canada)

- Trillium Book Award for Poetry: DADDY, Jake Byrne (Brick Books)

- Prix Trillium: Céline au Congo, Aristote Kavungu (Les Éditions du Boréal)

- Prix du livre d’enfant Trillium: Le bonnet magique, Mireille Messier (Comme des géants)

- Several Ontario publishers saw their books named to the 2025 Giller Prize longlist, including ECW Press for An Astonishment of Stars by Kirti Bhadresa, Book*hug Press for Sugaring Off by Fanny Britt, The Porcupine’s Quill for Still by Joanna Cockerline, and Assembly Press for The Road Between Us by Bindu Suresh.

- Coach House Books for What I Know About You by Éric Chacour and House Of Anansi Press for Peacocks of Instagram: Stories by Deepa Rajagopalan.

- Several Ontario publishers won awards at the CCBC Book Awards, including winners Skating Wild on an Inland Sea by Jean E. Pendziwol and Todd Stewart, ill. (Groundwood Books), The Cricket War by Thọ Phạm and Sandra McTavish (Kids Can Press), Robot, Unicorn, Queen: Poems for You and Me by Shannon Bramer and Irene Luxbacher, ill. (Groundwood Books) and Alone: The Journeys of Three Young Refugees by Paul Tom and Mélanie Baillairgé, ill.; Arielle Aaronson, trans. (Groundwood Books).

Profile current as of October 6, 2025

Endnotes

1 Statistics Canada, Table 36-10-0452-01 – Culture and sport indicators by domain and sub-domain, by province and territory, product perspective, released June 2, 2022.

2 Statistics Canada, Table 21-10-0200-01 – Book publishers, summary statistics, released February 19, 2024.

3 ibid

4 BookNet Canada, The State of Publishing in Canada 2023, pp. 11

5 Ibid, pp. 4

6 ibid, pp. 5

7 ibid, pp.12

8 ibid

9 Association of Canadian Publishers, Results of the 2024 Canadian Book Publishing Industry Salary Survey, pp. 29

10 Ibid, pp. 9

11 Ibid, pp. 9

12 ibid

13 Ibid, pp. 26

14 Ibid, pp. 24

15 Ibid, pp. 10

16 Ibid, pp. 9

17 ibid

18 Ibid, pp. 10

19 Ibid, pp. 23

20 BookNet Canada, The State of Publishing in Canada 2023, pp. 10

21 Statistics Canada, Table 21-10-0200-01 – Book publishers, summary statistics, released February 19, 2024.

22 ibid

23 ibid

24 Statistics Canada, Table 36-10-0452-01 – Culture and sport indicators by domain and sub-domain, by province and territory, product perspective, released February 19, 2024.

25 Statistics Canada, Table 21-10-0042-01 – Book publishers, net value of book sales by customer category (x 1,000,000), released February 19, 2024.

26 ibid

27 BookNet Canada, The State of Publishing in Canada 2023, pp. 8

28 BookNet Canada, “2024 Canadian book market half-year review”, BookNet Canada, September 4, 2024.

29 BookNet Canada, Canadian Book Consumer Study 2024, pp. 5

30 ibid, pp. 9

31 ibid, pp. 8

32 Ibid, pp. 13.

33 Ibid, pp. 8

34 Ibid, pp. 5

35 Ibid, pp. 9

36 Ibid, pp. 11

37 Ibid, pp. 13

38 Ibid, pp. 16

39 Ibid, pp. 21

40 PwC, Global Entertainment & Media Outlook, 2024-2028: Canada, pp. 12

41 ibid

42 ibid

43 ibid

44 ibid

45 Ed Nawotka, “Spotify Expands Audiobook Add-On Service to 11 Markets”, Publishers Weekly, July 22, 2025.

46 PwC, Global Entertainment & Media Outlook, 2024-2028, pp. 23

47 ibid

48 BookNet Canada, Canadian Leisure & Reading Study 2024, pp. 5

49 Ibid

50 Cathrine Tunney, “Canada now has a minister of artificial intelligence. What will he do?”, CBC, May 17, 2025

51 Associated Press, “Margaret Atwood among thousands of authors demanding compensation from AI companies?”, CBC, July 18, 2023

52 The Authors Guild, “U.S. Copyright Office Releases Part 3 of AI Report: What Authors Should Know”, The Authors Guild, May 19, 2025

53 ibid

54 Ed Nawotka, “Federal Judge Rules AI Training Is Fair Use in Anthropic Copyright Case”, Publishers Weekly, June 25, 2025.

55 Jim Milliot, “Judge Rules Class Action Suit Against Anthropic Can Proceed”, Publishers Weekly, July 18, 2025.

56 The Authors Guild, “What Authors Need to Know About the $1.5 Billion Anthropic Settlement”, The Authors Guild, September 5, 2025

57 Ed Nawotka, “Canadian Author Sues Four AI Companies for Copyright Infringement”, Publishers Weekly, August 4, 2025.

58 Abby Hughes, “Author says 'AI-generated' books were published under her name. Amazon wouldn't take them down”, CBC, August 10, 2023

59 Josh O’Kane, “Canada’s independent book publishers face mounting costs and confusion with proposed U.S. tariffs”, The Globe and Mail, February 3, 2025

60 Associated Press, “Canadian book industry calls on government to keep it out of trade war”, CTV, April 1, 2025

61 Ed Nawotka, “Canadian Booksellers Unite in Tariff Fight”, Publishers Weekly, March 24, 2025

62 Josh O’Kane, “Canada’s independent book publishers face mounting costs and confusion with proposed U.S. tariffs”, The Globe and Mail, February 3, 2025

63 Darren Major, “Most of Canada's retaliatory tariffs are gone. Now what?”, CBC, September 1, 2025

64 Barbara Shecter, “Canada is ditching retaliatory tariffs, but relief at the grocery store may take time”, Financial Post, August 26, 2025

65 BookNet Canada, Canadian Leisure & Reading Study 2024, pp. 24

66 Association of Canadian Publishers, “Increase the Canada Book Fund – ensure the government keeps its promise!”