Industry Profile - Film & TV

December 2023 Profile

Introduction

Ontario has long stood as a substantial player in Canada’s film and television production industry, as well as in the global market. 2022 marked another record-breaking year, with Ontario reporting its highest production levels to date with 419 productions generating $3.15 billion in production spending for the economy.[1]

Industry Size and Economic Impact

Note: The following information on employment, revenue and the consumer market should be considered a snapshot of activity in the industry based on the best available information. All dollar figures are in CAD unless otherwise noted. Data from different sources may be inconsistent due to differing definitions of the film and television sector.

Employment and Wages

- In 2022, the Ontario film and television industry created 45,891 high-value full-time equivalent direct and spin-off jobs for Ontarians.[2]

- The Canadian Media Producers Association (CMPA) Profile 2022 found that between April 2021 and March 2022, the Canadian film and television production in Canada generated 240,760 jobs, an increase of 11% over the previous year. The majority of these (141,140) were in Foreign Location and Service, followed by Canadian content production (82,260) and broadcaster in-house production (17,360).[3]

Production Volume and Budgets

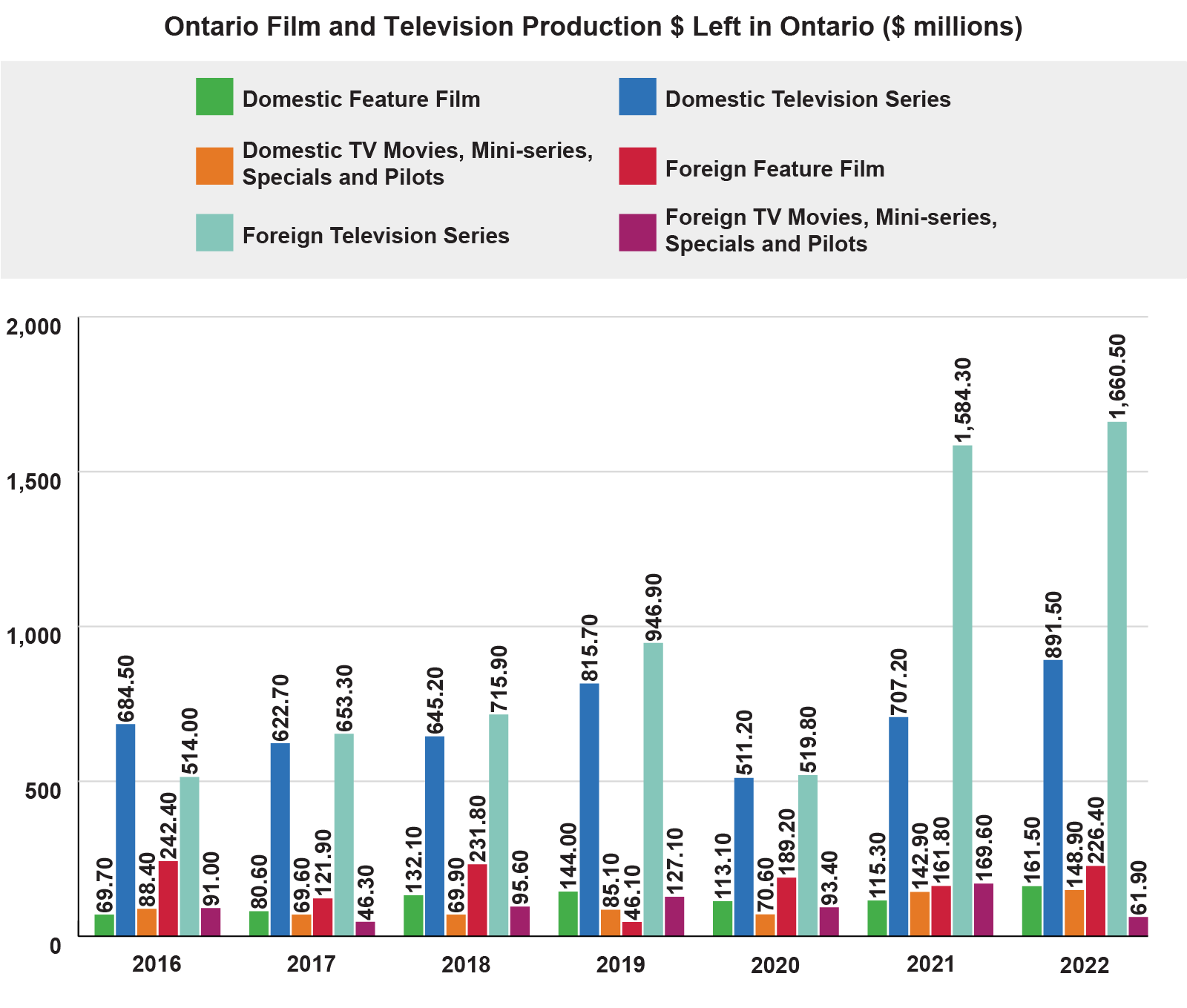

- A total of 419 film and television projects were produced in Ontario in 2022, which marks a significant increase from 232 in 2020 and 394 in 2021. Of those 419 projects, 316 were domestic, and 103 were foreign. Domestic film and television production, which increased 25% from 2021, now represents 38% of total film and television spending in Ontario.[4]

- In particular, 2022 was a strong year for domestic television series, with 155 productions contributing over $891 million in expenditures.[5]

- Live action production also increased in 2022, and accounted for 93% of total production.[6]

- In 2022, the Ontario film and television production sector contributed a record-breaking $3.15 billion to Ontario’s economy.[7] The Province saw growth across all categories of domestic production (feature film, television series, television movies/mini-series/specials/pilots) and growth across several categories of foreign production (feature film and television series). The only category that did not experience growth in 2022 was in the foreign television movies, mini-series, specials and pilots categories.[8]

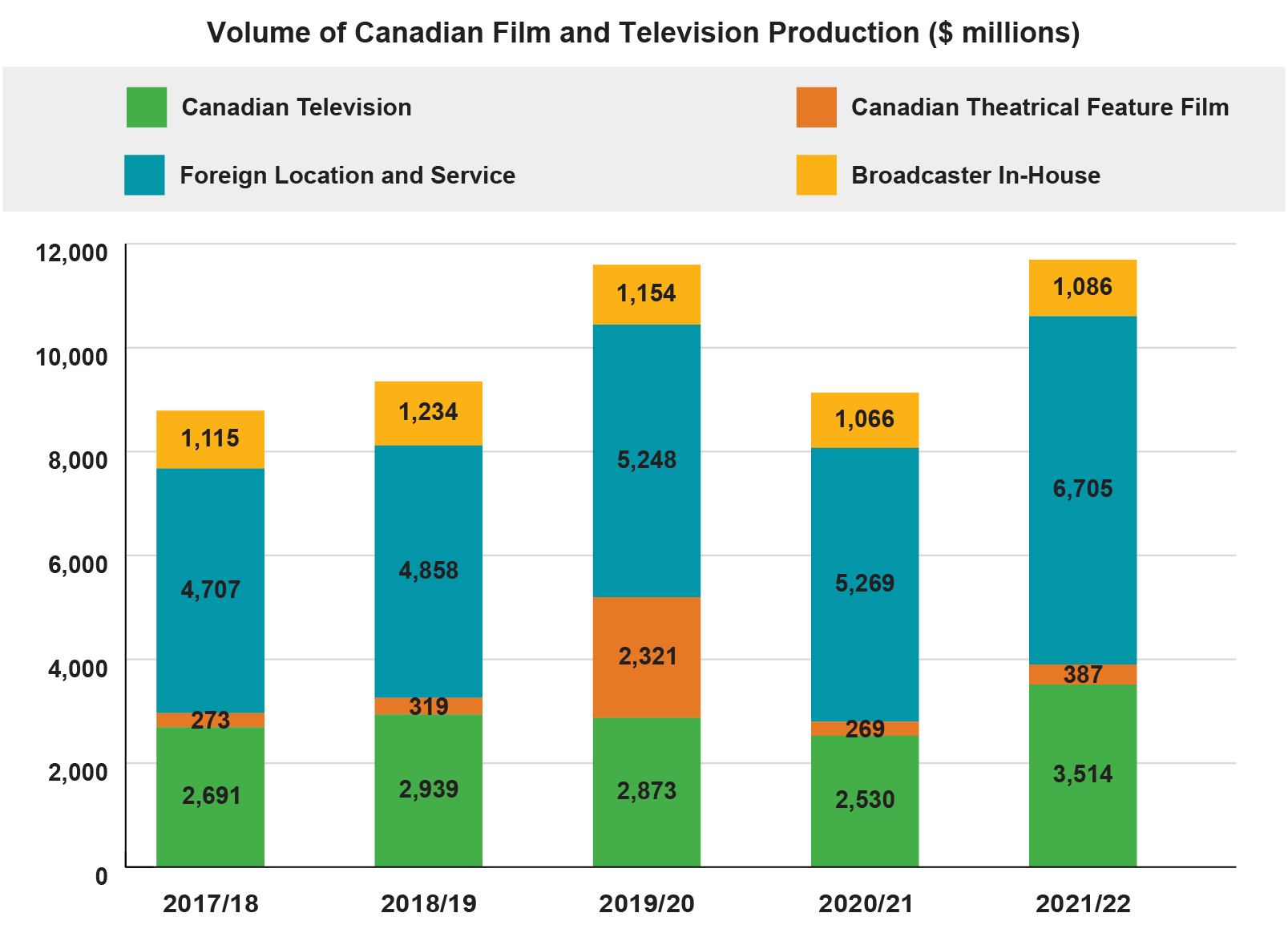

- According to the CMPA, between April 2021 and March 2022, the Canadian film and television production industry generated $11.69 billion in production volume, an increase of 28% from the previous fiscal year.[9] Notably, every segment of the film and television production industry experienced growth over this time period, and collectively, had an average annual growth rate of 28%.[10]

- Broadly, CMPA’s data highlights that Canadian content production increased by $39.5 to $3.90 billion in 2021-22 and identifies several growth areas within Canadian content production, including English-language production (+37.4%), French-language production (+44%), fiction (+44.7%), children and youth (+17.5%), documentary (+59%), lifestyle and human interest (+43.4%), and variety and performing arts (+2.2%). The report notes that animation production declined by 22.6% to $226 million in 2021-22.[11]

- Finally, CMPA’s data also highlights that Ontario accounts for the largest share (33%) of the total volume of film and television production in Canada, followed by British Columbia (32%) and Quebec (26%).[12] Moreover, Ontario also accounts for 42% of the total volume of Canadian content production, followed by Quebec (34%), and British Columbia (16%).[13]

Revenues and Related Figures

- In 2021, the Ontario film, television and video production industry generated almost $4.2 billion in operating revenue, accounting for 36% of Canada’s $11.3 billion. Ontario’s revenue was the highest in Canada, followed by British Columbia at $4.1 billion.[14]

- In 2021, the Ontario film, television and video post-production industry generated $416.3 million in revenue, 20% of Canada’s $2 billion. Ontario followed Quebec with just over $1 billion and British Columbia with $587.2 million.[15]

- The Canadian film and video sector generated $13.73 billion in GDP between April 2021 and March 2022, up 21% from the previous fiscal year.[16]

- According to estimates generated by Omdia and made available by the CRTC, internet-based video services generated approximately $4.6 billion in Canadian revenues in 2021 through subscription video on demand (SVOD), transactional video on demand (TVOD) and advertising video on demand (AVOD) services.[17]

- Analytics firm Gower Street has projected that global box office revenues could reach $32 billion USD in 2023, which would be a 23% increase from 2022 but still down from pre-pandemic (2019) figures.[18]

- According to PwC, revenues from cinema admissions continue to recover from COVID-19 and are projected to overtake pre-pandemic levels by 2027, reaching $917 million.[19]

Consumer Market

- Netflix continues to be the most popular streaming service in the market, followed by Disney+, Apple and Amazon. New entrants, like Discovery + and Paramount + have also entered the marketplace in recent years.

Trends and Issues

Key industry trends and issues include climbing over-the-top (OTT) video revenues vs. declining traditional TV and home video revenues; competition between streaming services, the fight for equity in front of and behind the camera; federal legislation; ongoing legal battles; and blockchain.

Growth Rate and Industry Trends

- Canada had the fourth largest TV subscription market in the world, after the United States, China, and India. PwC highlights that most pay TV providers have been successful at leveraging content rights through OTT in addition to existing services, and as a result, subscription revenues will increase at a 3.4% CAGR over the forecast period of 2023-2027.[20]

- Canada’s TV advertising market has continued to experience a decline due to a both a long-term move towards on-demand and OTT viewing amongst consumers. As such, TV advertising spend is expected to decline at a -0.2% CAGR through the forecast period of 2023-2027. PwC also highlights that this decline is expected to continue as streaming services continue to experiment with advertising, given their sizable amount of available consumer data.[21]

- Globally, subscription TV revenues are expected to decline over the forecast period of 2023-2027 at a 0.9% CAGR. In comparison, PwC anticipates slight growth (0.5% CAGR) for the total TV advertising market over that same period.[22]

- Canada is currently the fifth-largest OTT market in the world and is expected to continue to see modest growth of 3.3% CAGR over the forecast period of 2023-2027.[23] Despite this, Canada is expected to fall behind Australia and Germany over this period, and become the seventh-largest OTT market globally. The Canadian OTT market is dominated by SVOD services, which accounted for 74.5% of revenues in 2022, but this segment is expected to decline slightly to 71% by 2027, due to strong growth rates in the AVOD marketplace (13.2% CAGR).[24]

- PwC’s data suggests that total global OTT revenue will increase at a 4.6% CAGR over the forecast period of 2023-2027, and that the global OTT video market will increase at a 8.4% CAGR over that same period.[25] The SVOD market will continue to dominate, and is expected to pass the USD $100 billion milestone in 2025.[26]

- In July 2023, linear TV viewership share in the U.S. fell below 50% for the first time ever. Nielsen’s monthly data highlights that collectively, broadcast (20%) and cable TV (29.6%) platforms account for 49.6% of TV usage for July, whereas streaming accounts for 38.7%.[27]

- The summer edition of Vividata’s Study of the Canadian Consumer highlights that almost 70% of Canadians watch less than 2 hours of linear TV per day, with 1 in 5 saying that they don’t watch any. Interestingly, the study notes that the demographics most likely to not watch linear TV included adults in English Canada. For those who indicated they didn’t watch linear TV, they reported using Netflix (68%), Amazon Prime (59%) and, YouTube (43%). The report also indicates that this group is 38% more likely than the average Canadian to spend $60 or more on streaming services on a monthly basis.[28]

- Deloitte’s Digital Media Trends report highlights a potential challenge for streaming video providers: subscriber churn for U.S. Gen Z and millennial users. While this report indicates that overall subscriber churn for paid SVOD services (over a six month period) is 44%, this jumps to 67% for Gen Z and 62% for millennials. In particular, the report highlights the prevalence of “churn and return” for this demographic, which is subscribing to watch a specific piece of content, cancelling upon completion and re-subscribing once a new season (or other piece of content) is available.[29]

- Moreover, Deloitte highlights that current economic conditions have also played a role in how consumers have managed their subscription preferences. For instance, over half of consumers who responded to their survey indicated that they made a change to the entertainment subscriptions as a result of economic conditions, and around 60% of households indicated that they are now using a free, ad-supported streaming service.[30] Interestingly, there are generational nuances to consider – millennials spend the most on paid streaming video services (an average of USD $54 per month), churn through SVOD at a higher rate, and indicated that they are most likely to cancel paid gaming and music services.[31]

- 2022 and 2023 also signaled an important shift in the pricing strategies employed by the world’s largest streaming services, in response to concerns around the profitability of their business models.[32] Across the board, services like Disney+, Netflix, Apple TV, and Amazon Prime Video implemented price increases and the launch of new ad-supported pricing tiers in response to concerns around their profitability amidst a looming recessions, and heavy past investments into content.[33] For instance, Netflix ended its ad-free basic streaming plan ($9.99) in Canada, and now offers new or rejoining subscribers the option of a cheaper tier with ads ($5.99), or a more expensive standard plan ($16.99) in an effort to improve revenue generation. Canadian streaming services, like Crave, are also exploring the launch of their own ad-supported tiers to their platform pricing options.[34]

- Notably, Canada was also one of the test markets for Netflix’s crackdown on password sharing on its platform. In its Q1 2023 update to shareholders, the platform indicated that its move towards paid sharing resulted in significant growth in Canada’s paid membership base, and that as a result, Canadian market revenues are accelerating faster than in the U.S.[35]

- A survey conducted by Roku highlights that there are approximately 23.1 million internet users in Canada who stream television content. In 2022, TV streamers used or subscribed to an average of 3.4 video-on-demand services, an increase from 2.8 in 2021. Consumers are increasingly exploring other on-demand services, with the study noting that 52% of Canadians spend at least 5 hours per week with BVOD (broadcast video on demand) and AVOD. Notably, the report highlights the rise of what it calls “FlexiVODs” which are consumers that are flexible with regards to their TV streaming habits in response to external and internal circumstances like cost, content offerings, etc. Roku’s data highlights that 47% of streaming consumers plan to make changes to their services in the next year, including cancelling, subscribing or re-subscribing.[36]

Global and Domestic Issues

- On May 2, 2023, the Writers Guild of America (WGA) commenced a major work stoppage, marking the first time Hollywood had gone on strike in 15 years. The work stoppage followed failed labour negotiations with the Alliance of Motion Picture and Television Producers, which represents both streaming platforms and studios in collective bargaining. [37] The core issues at stake for WGA included minimum basic compensation across different forms of content, increased residuals, increased contributions to benefits like health plans and pensions, strengthening of professional standards and overall protections, as well as emerging issues like proposals to limit and regulate the use of AI tools like ChatGPT.[38] In July 2023, Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA) joined WGA on the picket lines, marking the first time since 1960 where both actors and writers were on strike at the same time.[39]

- After 148 days, the WGA strike ended with an agreement that included increases in compensation, a streaming residual structure based on viewership for high-budget SVOD, weekly rate tiers for writer producers, and minimum staffing levels for post-greenlight rooms. Additionally it established regulations regarding the use of artificial intelligence and disclosure of its use.[40]

- The SAG-AFTRA strike concluded after118 days. Domestically it affected thousands of Canadians working in the sector.[41] The new agreement includes provisions around consent and compensation related to the use of artificial intelligence, compensation increases, increased caps for pension and health plans, as well as provisions to protect diverse communities.[42]

- The economic impact of a protracted work stoppage remains to be seen but is expected to be significant. Observers, quoted in The Hollywood Reporter, suggests that the economic impact could eclipse the $2 billion USD lost during the last writers’ strike, which lasted 100 days.[43] The work stoppage has had an impact on levels of foreign service production within Canada (and Ontario), as well as scheduled events at TIFF, as SAG-AFTRA members were not undertaking promotional activities during the work stoppage.[44]

- VFX workers in the U.S. have made their first move towards unionization. The VFX crews employed at Marvel Studios have voted to unionize through IATSE.[45]

- The Online Streaming Act received royal assent on April 27, 2023 and marks the first major reform of Canadian broadcasting legislation since 1991. The goal of the Online Streaming Act is to ensure that Canadian stories are widely available on streaming platforms, and will require services (foreign and domestic) to contribute to the creation, production and distribution of Canadian stories.[46] The Act is intended to be implemented by the CRTC, and to that end, the CRTC has launched several consultations. . Notably, the federal government also released a policy direction to guide this implementation process.[47]

- The first policy decision issued by the CRTC was the requirement that services making over $10 million annually (either as a standalone service, or part of a broadcast group) must register with the CRTC and provide some basic information about their offerings. The services must register with the CRTC once, and this list will be made available on the CRTC website. It collects basic information about the service and its offerings (including the type of service offered, information about languages the programming is available in, launch date,).[48] These services will also be subject to filing annual reports with the CRTC, with the goal of collecting additional information about the services and their offerings in the Canadian marketplace.[49]

- The CRTC continues to consult regarding the appropriate level and method to determine contributions to the broadcast system to support Canadian and Indigenous content. A three-week long hearing was held in Ottawa beginning on November 20, 2023 in Ottawa.[50]

- New research from Reel Canada and VICE Media Group showcases the importance of exposing Canadian youth to Canadian film. According to this study of high school students (14-19) and K-12 teachers, two-thirds of Canadian students who see Canadian films in class say that they make them feel a sense of pride in Canada, compared with only half of students who are not so exposed.[51]

- A recent research report from the Canadian Media Producers Association examined a series of international policies and programs intended to assist screen-based companies in retaining their intellectual property. This is noted as the most important success factor in building robust companies.[52]

- Australia announced that it was preparing to impose local content quotas on streaming platforms, as part of Reveal, its cultural policy review process. While further details are expected in the coming months, industry observers have indicated that they expect the policy to include: a mandated share of revenue spent on Australian content, requirements for privileged genres, and minimum discoverability quotas.[53]

- Disney+ has indicated that it would suspend the commissioning of local programming across its brands in Canada until at least the end of 2023, and possibly extending into 2024. Variety’s reporting suggests that one reason may be uncertainty relating to the Online Streaming Act, as well as Disney’s ongoing financial issues and cost-saving initiatives. Variety’s reporting also highlights that despite entering the market in 2019, Disney+ has yet to commission any original programming.[54]

- In May 2023, the United Kingdom-based Pinewood Group announced that it had acquired full ownership of Pinewood Toronto Studios. The 490,000 square foot facility and production space was formerly owned in a majority capacity by Bell Media.[55]

- Winnie Luk was appointed as the inaugural Executive Director of the Disability Screen Office. Launched in 2022, the Disability Screen Office aims to improve accessibility and disability representation in Canada’s film and television industry.[56]

- CBC/Radio-Canada has announced plans to cut 600 jobs and reduce its programming in an effort to reduce their expenses by $125 million. Included in the cuts is a reduction of $40 million in independent production commissions and program acquisitions.[57]

- Representation, both behind and on the screen, continues to be an ongoing issue for the sector. Several recent research reports have provided key insights:

- USC Annenburg’s analysis of the 100 highest-grossing movies in 2022 highlights that non-white people remain underrepresented onscreen, accounting for 38.3% of onscreen characters compared to 41.1% of the U.S. population. In fact, the study highlights that across the 16 years it has been running, the only ethnicity and race that has seen any improvement has been Asians (3.4% in 2007 to 15.9% in 2022).[58]

- ReFrame’s Report on Gender & Hiring on TV highlights that 54% of the top 22 scripted television series in the 2022-23 season featured a woman in the lead role, which was an increase from last year (45.5%). While there was some good news in terms of reaching gender parity for writers with 50.08% of episodes in this same penned by women, only 31 of 113 pilot helming jobs were held by women, and only 3 of those 113 were held by women of colour.[59]

- A USC Annenburg report looking at the gender and race/ethnicity of directors across 2022’s 100 highest-grossing movies highlighted that only 9% of the director jobs were held by women, down from 12.7% in 2021 and 16% in 2020.[60]

- GLAAD’s annual Where We Are on TV report for 2022-2023 also highlights that across regulars on scripted primetime broadcast series, only 10.6% were LGBTQ, which is a decrease of 1.3% from 2021-22. The study also provides detail on the number of characters on primetime scripted cable (129), streaming services (356) – both of which were decreases in the number of LGBTQ characters onscreen.[61]

- The Black Screen Office issued a series of landmark reports, designed to accelerate system change towards equity and authentic content creation in Canada’s screen industries.

- Being Heard: Black Canadians in the Canadian Screen Industries provides data on how to address anti-Black bias and systemic exclusionary practices in order to build a more equitable screen-sector workforce.

- Being Counted: Canadian Race-based AudienceSurvey looks at viewing habits and consumer preferences for Black, Indigenous and People of Colour.

- Being Seen: Directives for creating authentic and inclusive content provides guidance on creating and commissioning more authentic and representative screen-based content.

- Research from the DOC Institute highlights the experiences of Black, Indigenous and People of Colour documentary creators who are navigating public funding to support documentary production. The data uncovers obstacles in terms of data collection, applying for funding, and intellectual property ownership.[62]

- Women in Film recently released the results of a survey measuring the perceived changes in the industry within the five years following the #MeToo movement. While more than 70% of respondents highlighted that the industry’s culture of abuse, harassment and misconduct has improved somewhat, 69% of respondents reported personally experiencing abuse or misconduct within the last few years (with another 30.9% reporting that an incident of abuse or misconduct happened to someone they know).[63]

- Several jurisdictions have proposed or made recent changes to their tax credit incentive regimes for film and television production, including:

- The state of California has indicated that it plans to add a diversity requirement to its tax incentive for film and TV production. The proposed change will be to require productions that receive the tax credit to set hiring goals that are broadly reflective of California’s population, in terms of race, ethnicity and gender.[64]

- The state of Georgia announced that it would be reviewing its slate of tax credits, including the $1.3 billion film tax credit which is the largest in the country.[65]

- The state of New York has indicated that it would be increasing the cap on its film and television tax credits from $420 million to $700 million. Other changes include making above-the-line wage costs eligible, and raising the credit to 30%.[66]

- The United Kingdom announced a series of changes to its incentive programs, including modifying the existing rebate into an “expenditure credit” with an accompanying 0.5% increase in the incentive.[67]

- A group of U.S.-based organizations, including the FWD-Doc, Film Event Accessibility Working Group, Film Festival Alliance, and 1IN4 Coalition, launched an Accessibility Scorecard to help film event organizers, filmmakers and guests participate in the collection of accessibility data. The free tool is an online survey that film festivals and events can share with their guests, and the data will be made available back to film festivals and events as aggregate data to help events and festivals identify key areas of improvement.[68]

- Climate change and sustainability continues to be a hot button conversation within the industry.

- Data from the Sustainability in Production Alliance, cited by The Hollywood Reporter, indicates that tentpole productions (budgets more than $70 million) had an average carbon footprint of 33 metric tons per shooting day. For tentpole productions, fuel consumption made up nearly half of their CO₂ footprint, and air travel was responsible for 25%.[69]

- In response to some of these concerns, two new studios have opened up with a focus on sustainability. The Electric Owl Studios in Georgia, opened in summer 2023, is the world’s first production studio to launch with a LEED Gold certification in place. Work is also set to begin in 2024 or 2025 on Portugal’s Tage Studios, which will become Europe’s first truly green studio.[70]

- The Academy of Canadian Cinema & Television has launched a new award celebrating a production that has shown excellence in sustainable production initiatives, and that has had a measurable reduction in greenhouse gas emissions and/or innovations in circularity. The first Sustainable Production Award will be awarded at the 2024 Canadian Screen Awards.[71]

- In June 2023, a group of 22 Canadian broadcasters formed the Canadian Broadcasters for Sustainability, a working group committed to collectively working towards environmentally sustainable change. The groups’ stated goals include: collaborate on sustainability initiatives to avoid duplication and ensure resources and learnings have more impact; increase the scope and impact of sustainability actions; improve efforts to produce content sustainably including how carbon impact is measured and addressed; reach more audiences with content that inspires people to make more sustainable choices and is informed by science; and understand and consult with marginalized communities that are disproportionately affected by climate change. [72]

- A recent study from USC Annenburg’s Norman Lear Center and Good Energy showcases the climate change is largely absent in scripted entertainment from 2016-2020 – only 2.8% of all film and TV scripts analyzed from this period contained any climate-related keywords.[73]

- Audience data collected by a CBC survey of 2,000 English-speaking adults in Canada highlighted that there is an appetite for climate change to appear within entertainment programming. Specifically, 76% of respondents indicated that it was ‘very or somewhat’ important to have climate change within entertainment programming.[74]

- Recent research commissioned by the Canadian Media Producers Association examines green budgets, and specifically, the budget implications of electric generator alternatives, greener studio offerings, electric vehicle options, and improved waste management and circularity opportunities. The study concludes that initially, productions may be served by focusing on making sustainability gains on electric vehicles and electric generators, while progress on waste and greener studios have less immediate benefit.[75]

- A study commissioned by Telefilm examined eco-awareness among workers in the screen-based industry in Canada. Broadly, the study showcased that 67% of workers had heard of sustainable/green production practices in the workplace, and 96% think it is important that their workplace incorporate these principles.[76] The practices best known were those related to recycling and compost programs, upcycling, and green transportation options, and respondents indicating wanting more of the following: tools and help to understand best practices, financial incentives and directory of green vendors/suppliers.[77]

- In 2023, Netflix announced a partnership with General Motors that would result in an increased presence of electric vehicles within content on its platform, through its Entertain to Sustain initiative.[78] Coverage from The Hollywood Reporter suggests that these kinds of content initiatives are also part of a wider sectoral trend towards wanting to court ESG investors.[79]

- Film production continues to occur all over the Province, including in cities like Cambridge, who set a new record of 75 days of filming in 2022.[80] In Kingston, Branded to Film is looking at training and growing a local film production workforce there through its “pioneering hyperlocal” production model, with a goal of creating a $100 million production sector in South Eastern Ontario.[81]

Government Support

Note: The information included in this section is an overview of some of the government support to the film and television sector. This is not intended to be a comprehensive list of government support available.

- Ontario film and television producers have access to provincial government funding through tax credits including the Ontario Film and Television Tax Credit (OFTTC), the Ontario Computer Animation and Special Effects Tax Credit (OCASE), and the Ontario Production Services Tax Credit (OPSTC). Ontario Creates provides funding to trade and event organizations in the production sector through the Industry Development Program for events and activities that stimulate the growth of the industry, and for producers to participate in export activities through the Export Fund – Film and Television.

- On November 14, 2022, Ontario introduced a legislative amendment to the Ontario Production Services Tax Credit to allow applicants to claim a portion of their location fees. This legislative amendment passed into law on December 8, 2022.

- On August 24, 2023, Ontario made significant regulatory changes to Ontario’s film and television tax credits. These amendments implement previously announced commitments to extend eligibility for the film and television tax credits to productions released exclusively online, as announced in the 2022 Budget; and introduce a screen credit requirement, as announced in the 2022 Economic Outlook and Fiscal Review.

- Ontario feature film producers also have access to provincial government funding through the Ontario Creates Film Fund in Production, Development and Marketing and Distribution Initiative streams. The Fund is designed to increase the level of domestic feature film production in Ontario, and provides support to feature film producers in the final stages of development and production financing.

- Ontario Creates has launched Ontario Green Screen initiative, a collaborative initiative between government, industry partners, unions, guilds, trade associations and companies that endeavours to make lasting change in the industry and to empower individuals, production companies and studios to make sustainable choices. Ontario Green Screen recently launched its 2023-27 Strategic Plan.[82] Ontario Green Screen has also launched a number of new resources, including a Grid Tie-In Map outlining green power at locations across the Province.

- BDC unveiled a $30 million financing envelope targeted towards Canada’s creative and cultural industries. As part of this initiative, BDC also announced a partnership with Telefilm Canada aimed at developing a financial support referral program, increasing awareness of available financing solutions within the audiovisual industry, and exploring joint financing or advisory programs based on industry needs.[83]

Industry Recognition

- The Indigenous Screen Office hosted the first-ever International Indigenous Co-Production Forum at Cannes, as part of the Canadian Pavilion, in partnership with Ontario Creates and supported by Telefilm. Through this initiative, the ISO hosted 21 producer/filmmaker delegates from Canada, Australia, Aotearoa/New Zealand, Greenland, Norway and Sweden, and showcased case studies of two successful Indigenous co-productions: Night Raiders and Twice Colonized.

- Seven films supported by Ontario Creates screened at the Toronto International Film Festival in September 2023, including: Seven Veils, Backspot, Close To You, Fitting In, Swan Song, The King Tide, and Mr.Dressup: The Magic of Make Believe.

- Several films supported by Ontario Creates won Canadian Screen Awards in 2023, including: Brother, Buffy Sainte Marie: Carry It On, Crimes of the Future, Sex with Sue, The Colour of Ink, and The Swearing Jar.

Profile current as of December 8, 2023

Endnotes

1 Ontario Creates, 2022 Production Statistics, 2023.

2 ibid

3 Canadian Media Producers Association, Profile 2022, 2023, pp. 14

4 Ontario Creates, 2022 Production Statistics, 2023.

5 ibid

6 ibid

7 Ontario Creates, 2020 Production Statistics, 2021.

8 ibid

9 Canadian Media Producers Association, Profile 2022, 2023, p. 4.

10 ibid, p. 9

11 Ibid, p. 20

12 Ibid. p. 12

13 Ibid, p.28

14 Statistics Canada, Table 21-10-0059-01 – Film, television and video production, summary statistics. (Accessed August 14, 2023).

15 Statistics Canada, Table 21-10-0066-01 – Film, television and video post-production, summary statistics. (Accessed August 14, 2023)

16 Canadian Media Producers Association, Profile 2022, 2023, p. 4.

17 Canadian Radio-television and Telecommunications Commission, Communications Market Reports – Open Data, Data – TV, TV-11. (Accessed August 14, 2023).

18 Pamela McClintock, “Box Office: New 2023 Global Revenue Forecast Issued on Eve of CinemaCon”, The Hollywood Reporter, April 23, 2023

19 PwC, Global Entertainment & Media Outlook 2023-2027 – Canada, 2023

20 ibid

21 ibid

22 PwC, Global Entertainment & Media Outlook 2023-2027 – Global, 2023

23 PwC, Global Entertainment & Media Outlook 2023-2027 – Canada, 2023

24 ibid

25 PwC, Global Entertainment & Media Outlook 2023-2027 – Global, 2023

26 ibid

27 Rick Porter, “Linear TV Falls Below 50 Percent of Viewing for the First Time”, The Hollywood Reporter, August 15, 2023

28 Vividata, “Vividata releases its first Summer SCC – Study of the Canadian Consumer since 2018”, (Accessed August 14, 2023).

29 Kevin Westcott, Jana Arbanas, Chris Arkenburg, Brooke Auxler, “2023 Digital media trends: Immersed and connected”, Deloitte Insights, April 14, 2023

30 ibid

31 ibid

32 Brent Lang, Brian Steinberg, “Why Wall Street Fell Out of Love with Netflix and Other Media Companies”, Variety, October 13, 2022

33 J.Clara Chan, “Price Hikes at Streaming Giants May Fuel Churn Rates as Consumers Opt Out”, The Hollywood Reporter, November 9, 2022

34 Etan Vlessing,”Crave plans ad tiers for subscription streaming service in Canada”, The Hollywood Reporter, June 8, 2023

35 Etan Vlessing, “Netflix scraps ad-free basic streaming plan in Canada”, The Hollywood Reporter, June 26, 2023

36 Roku Advertising, Video-on-Demand Evolution 2023, p. 5, 9. 11

37 Katie Kilkenny, “Writers Guild Calls First Strike in 15 Years”, The Hollywood Reporter, May 1, 2023

38 Jason P. Frank, “The 2023 Hollywood Strike for Dummies”, Vulture, August 14, 2023

39 Gene Maddaus, “SAG-AFTRA Declares Double Strike as Actors Join Writers on Picket Lines”, Variety, July 13, 2023

40 Kelly Townsend, “WGA strike ends after 148 days following tentative agreement”, Playback, September 27, 2023

41 Kelly Townsend, “SAG-AFTRA, AMPTP make tentative deal to end strike”, Playback, November 9, 2023

42 ibis

43 Winston Cho, “Writers Strike Fallout: $2B Economic Impact May Be Just The Beginning”, The Hollywood Reporter, May 5, 2023

44 Josh O’Kane, “How the Hollywood actors’ strike could affect Canadian productions – and possibly TIFF”,The Globe & Mail, August 3, 2023.

45 Angelique Jackson, “Marvel VFX Artists Will Vote to Unionize”, Variety, August 7, 2023

46 Canadian Heritage, “Online Streaming Act receives Royal Assent”, April 27, 2023

47 Canada Gazette, Order Issuing Directions to the CRTC (Sustainable and Equitable Broadcasting Regulatory Framework): SOR/2023-239, November 9, 2023

48 CRTC, Broadcasting Regulatory Policy CRTC 2023-331 and Broadcasting Order CRTC 2023-332, September 29, 2023

49 ibid

50 CRTC, The Path Forward – Working towards a modernized regulatory framework regarding contributions to support Canadian and Indigenous content

51 Reel Canada and VICE Media Group, The Power of Canadian Film: Youth Film Consumption and Engagement, 2023, p. 11

52 Canadian Media Producers Association, International Review of Policies and Programs that Support the Development, Retention and Exploitation of IP by Independent Producers, p. 3

53 Patrick Brzeski,”Australia to Impose Local Content Quotas on Streaming Platforms”, The Hollywood Reporter, January 30, 2023

54 Manori Ravindran, “Disney+ Has Paused Original Commissions in Canada”, Variety , June 15, 2023

55 Etan Vlessing, “Pinewood Group Acquires Full Ownership of Toronto Mega-Studio, The Hollywood Reporter, May 3, 2023

56 Victoria Ahearn, “Winnie Luk named Disability Screen Office Executive Director”, Playback, May 31, 2023

57 CBC Media Centre, “CBC/RADIO-CANADA ANNOUNCES PROGRAMMING AND JOB CUTS”, December 04, 2023

58 Rebecca Sun, “Culture Shift: Asian Representation in Movies Rose 12.5 percent in 16 Years, Study Finds”, The Hollywood Reporter,, August 17, 2023

59 Rebecca Sun, “Women Star in Majority of the Most Popular TV Shows, Study Finds”, The Hollywood Reporter, August 16, 2023

60 Rebecca Sun, “Latest Diversity Reports from USD, SDSU Reveal Room for Improvement Behind the Camera”, The Hollywood Reporter, January 2, 2023

61 GLAAD, Where We Are on TV 2022-2023, p.8

62 DOC Institute, Funding Analysis for BIPOC Documentary Content in Canada, p. 2-3

63 Mia Galuppo, “#MeToo, 5 Years Later: Survey Reports Employees Still Experiencing Abuse, Harassment in Hollywood”, The Hollywood Reporter, October 5, 2022

64 Gene Maddaus, “California to Add Diversity Rules to State Film and TV Credit”, Variety August 18, 2022

65 Gene Maddaus, “Georgia Lawmakers to Review State’s $1.3 Billion Film Credit”, Variety, March 2, 2023

66 Winston Cho, “New York to Make Major Changes to Tax Incentive Program”, The Hollywood Reporter, April 28, 2023

67 Georg Szalai, “U.K. to Remodel and Raise Production Incentives”, The Hollywood Reporter, March 15, 2023

68 Catherine Dulude, “Accessibility at Film Events: A New Tool to Collect Data”, Canada Media Fund, January 19, 2023

69 Scott Roxborough, “Two New Studios Represent the Future of Green Filmmaking”, The Hollywood Reporter, March 22, 2023

70 ibid

71 Academy of Canadian Cinema & Television, “The Canadian Academy announces the Sustainable Production Award, presented by CBC for the 2024 Canadian Screen Awards”, April 11, 2023

72 CBC, “Canada’s leading media companies announce Canadian Broadcasters for Sustainability”, June 11, 2023

73 USC Annenberg Norman Lear Center, Good Energy, A Glaring Absence: The Climate Crisis is Virtually Nonexistent in Scripted Entertainment, p. 2

74 CBC, Climate Change in Entertainment Programming: What do Canadian audiences want?”, p. 6

75 Earth Angel Canada, Towards a Green Budget Framework in Canada, March 2023, p. 6,11

76 Telefilm, Eco-Awareness Survey: Interest and Implementation of Sustainable/Green Production Practices, September 2022, p. 7

77 ibid

78 Jon Alain Guzik, “Behind Netflix and GM’s Plan to Give EVs More Screen Time”, The Hollywood Reporter, March 22, 2023

79 Alex Weprin, “Hollywood Courts Wall Street’s ESG Investors Mainly with Film and TV Messages, Not Carbon Offsets”, The Hollywood Reporter, March 22, 2023

80 Carmen Groleau, “How Cambridget’s film scene has grown and created a ‘sense of pride’ for city”, CBC News, March 21, 2023

81 Victoria Ahearn, “Hyperlocal and Hip: J.Joly’s ‘pioneering’ production model, Playback, September 26, 2022

82 Ontario Green Screen, Ontario Green Screen Strategic Plan 2023-2027,

83 BDC, “BDC launches a $30 million financing envelope to accelerate the growth of Canada’s creative and cultural industries”, February 2, 2023